MasterCard 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

PART II

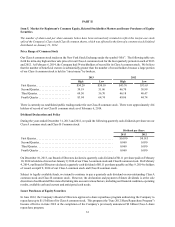

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

The number of shares and per share amounts below have been retroactively restated to reflect the ten-for-one stock

split of the Company's Class A and Class B common shares, which was effected in the form of a common stock dividend

distributed on January 21, 2014.

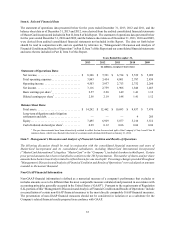

Price Range of Common Stock

Our Class A common stock trades on the New York Stock Exchange under the symbol “MA”. The following table sets

forth the intra-day high and low sale prices for our Class A common stock for the four quarterly periods in each of 2013

and 2012. At February 6, 2014, the Company had 54 stockholders of record for its Class A common stock. We believe

that the number of beneficial owners is substantially greater than the number of record holders because a large portion

of our Class A common stock is held in “street name” by brokers.

2013 2012

High Low High Low

First Quarter. . . . . . . . . . . . . . . . . . . . . . . . $54.20 $50.10 $43.76 $33.63

Second Quarter. . . . . . . . . . . . . . . . . . . . . . 59.19 51.86 46.70 38.99

Third Quarter . . . . . . . . . . . . . . . . . . . . . . . 69.50 56.70 46.18 40.47

Fourth Quarter . . . . . . . . . . . . . . . . . . . . . . 83.94 64.74 49.86 44.74

There is currently no established public trading market for our Class B common stock. There were approximately 414

holders of record of our Class B common stock as of February 6, 2014.

Dividend Declaration and Policy

During the years ended December 31, 2013 and 2012, we paid the following quarterly cash dividends per share on our

Class A common stock and Class B Common stock:

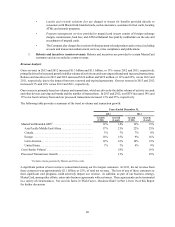

Dividend per Share

2013 2012

First Quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.030 $0.015

Second Quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.060 0.030

Third Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.060 0.030

Fourth Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.060 0.030

On December 10, 2013, our Board of Directors declared a quarterly cash dividend of $0.11 per share paid on February

10, 2014 to holders of record on January 9, 2014 of our Class A common stock and Class B common stock. On February

4, 2014, our Board of Directors declared a quarterly cash dividend of $0.11 per share payable on May 9, 2014 to holders

of record on April 9, 2014 of our Class A common stock and Class B common stock.

Subject to legally available funds, we intend to continue to pay a quarterly cash dividend on our outstanding Class A

common stock and Class B common stock. However, the declaration and payment of future dividends is at the sole

discretion of our Board of Directors after taking into account various factors, including our financial condition, operating

results, available cash and current and anticipated cash needs.

Issuer Purchases of Equity Securities

In June 2012, the Company’s Board of Directors approved a share repurchase program authorizing the Company to

repurchase up to $1.5 billion of its Class A common stock. This program (the "June 2012 Share Repurchase Program")

became effective in June 2012 at the completion of the Company’s previously announced $2 billion Class A share

repurchase program.