MasterCard 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

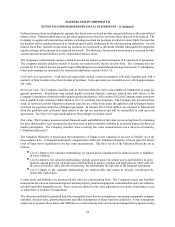

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

66

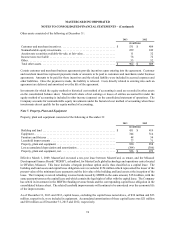

Leases - The Company enters into operating and capital leases for the use of premises, software and equipment. Rent

expense related to lease agreements that contain lease incentives is recorded on a straight-line basis over the term of

the lease.

Pension and other postretirement plans - The Company recognizes the overfunded or underfunded status of its single-

employer defined benefit plans or postretirement plans as assets or liabilities on its balance sheet and recognizes changes

in the funded status in the year in which the changes occur through other comprehensive income. The funded status

is measured as the difference between the fair value of plan assets and the benefit obligation at December 31, the

measurement date. The fair value of plan assets represents the current market value of the pension assets. Overfunded

plans are aggregated and recorded in long-term other assets, while underfunded plans are aggregated and recorded as

accrued expenses and long-term other liabilities.

Net periodic pension and postretirement benefit cost/(income) is recognized in general and administrative expenses in

the consolidated statement of operations. These costs include service costs, interest cost, expected return on plan assets,

amortization of prior service costs or credits and gains or losses previously recognized as a component of other

comprehensive income or loss.

Defined contribution savings plans - The Company's contributions to defined contribution savings plans are recorded

when the employee renders service to the Company. The charge is recorded in general and administrative expenses.

Advertising expense - The cost of media advertising is expensed when the advertising takes place. Advertising production

costs are expensed as incurred. Promotional items are expensed at the time the promotional event occurs. Sponsorship

costs are recognized over the period of benefit.

Foreign currency remeasurement and translation - Monetary assets and liabilities are remeasured to functional

currencies using current exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are

recorded at historical exchange rates. Revenue and expense accounts are remeasured at the weighted-average exchange

rate for the period. Resulting exchange gains and losses related to remeasurement are included in general and

administrative expenses on the consolidated statement of operations.

Where a non-U.S. currency is the functional currency, translation from that functional currency to U.S. dollars is

performed for balance sheet accounts using current exchange rates in effect at the balance sheet date and for revenue

and expense accounts using a weighted-average exchange rate for the period. Resulting translation adjustments are

reported as a component of other comprehensive income (loss).

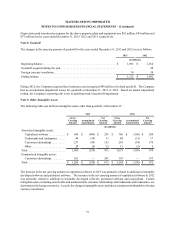

Stock split - On December 10, 2013, the Board of Directors declared a ten-for-one stock split of the Company's Class

A and Class B common shares, which was effected in the form of a common stock dividend distributed on January 21,

2014. Except for the amount of authorized shares and par value, all references to share and per share amounts in the

consolidated financial statements and accompanying notes to the consolidated financial statements have been

retroactively restated to reflect the stock split.

Treasury stock - The Company records the repurchase of shares of its common stock at cost on the settlement date of

the transaction. These shares are considered treasury stock, which is a reduction to stockholders' equity. Treasury stock

is included in authorized and issued shares but excluded from outstanding shares.

Share-based payments - The Company measures share-based compensation expense at the grant date, based on the

estimated fair value of the award and uses the straight-line method of attribution, net of estimated forfeitures, for

expensing awards over the requisite employee service period. The Company estimates the fair value of its non-qualified

stock option awards using a Black-Scholes valuation model. The fair value of restricted stock units ("RSUs"), including

performance stock units ("PSUs") granted prior to 2013, is determined and fixed on the grant date based on the Company's

stock price, adjusted for the exclusion of dividend equivalents. The Monte Carlo simulation valuation model was used

to determine the grant date fair value of PSUs granted in the first quarter of 2013. All share-based compensation

expenses are recorded in general and administrative expenses.