MasterCard 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

98

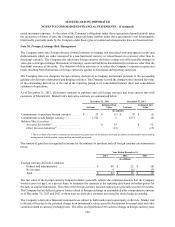

In addition, the European Commission decision could lead to additional competition authorities in European Union

member states commencing investigations or proceedings regarding domestic interchange fees or initiating regulation.

The possibility of such actions has increased due to the judgment of the General Court. The judgment also increases

the possibility of an adverse outcome for the Company in related and pending matters (such as the interchange

proceedings in Hungary, Italy and Poland, as indicated below). In addition, the European Commission’s decision could

lead, and in the case of the United Kingdom and Belgium has led, to the filing of private actions against MasterCard

Europe by merchants and/or consumers which, if MasterCard is unsuccessful in its appeal of the General Court decision,

could result in MasterCard owing substantial damages.

In April 2013, the European Commission announced that it has opened proceedings to investigate: (1) MasterCard’s

interregional interchange fees that apply when a card issued outside the EEA is used at a merchant location in the EEA,

(2) central acquiring rules, which apply when a merchant uses the services of an acquirer established in another country

and (3) other business rules and practices (including the “honor all cards” rule).

Additional Litigations in Europe. In the United Kingdom, beginning in May 2012, a number of retailers have filed

claims against MasterCard for unspecified damages with respect to MasterCard’s cross-border interchange fees and its

U.K. and Ireland domestic interchange fees. In June 2013, the court denied MasterCard’s request to stay the proceedings

pending the result of MasterCard's appeal of the European Union General Court's judgment discussed above, but the

court indicated it would not issue a final decision until the Court of Justice issues its decision. In Belgium, a retailer

filed claims in December 2012 for unspecified damages with respect to MasterCard’s cross-border and domestic

interchange fees paid in Belgium, Greece and Luxembourg.

Additional Interchange Proceedings. In February 2007, the Office for Fair Trading of the United Kingdom (the “OFT”)

commenced an investigation of MasterCard's current U.K. default credit card interchange fees and so-called “immediate

debit” cards to determine whether such fees contravene U.K. and European Union competition law. The OFT had

informed MasterCard that it did not intend to issue a Statement of Objections or otherwise commence formal proceedings

with respect to the investigation prior to the judgment of the General Court of the European Union with respect to

MasterCard's appeal of the December 2007 cross-border interchange fee decision of the European Commission, and

this period was extended until the completion of MasterCard's appeal to the Court of Justice. If the OFT ultimately

determines that any of MasterCard’s U.K. interchange fees contravene U.K. and European Union competition law, it

may issue a new decision and possibly levy fines accruing from the date of its first decision. Such a decision could

lead to the filing of private actions against MasterCard by merchants and/or consumers which could result in an award

or awards of substantial damages and could have a significant adverse impact on the revenue of MasterCard

International's U.K. customers and MasterCard's overall business in the U.K.

Regulatory authorities in a number of other jurisdictions around the world, including Hungary, Italy, Netherlands and

Poland, have commenced competition-related proceedings or inquiries into interchange fees and acceptance practices.

In some of these jurisdictions, fines have been or could be assessed against MasterCard. These matters could have a

negative impact on MasterCard’s business in the specific country where the regulatory authority is located but would

not be expected to have a material impact on MasterCard’s overall revenue. In addition, regulatory authorities and/or

central banks in certain other jurisdictions, including Brazil, Chile, Denmark, Germany, Latvia, Portugal, Russia,

Singapore and South Africa, are reviewing MasterCard's and/or its customers' interchange fees and/or other practices

and may seek to commence proceedings related to, or otherwise regulate, the establishment of such fees and/or such

practices.

Other Regulatory Proceedings

In addition to challenges to interchange fees, MasterCard’s other standards and operations are also subject to regulatory

and/or legal review and/or challenges in a number of jurisdictions from time to time. These proceedings tend to reflect

the increasing global regulatory focus to which the payments industry is subject and, when taken as a whole with other

regulatory and legislative action, such actions could result in the imposition of costly new compliance burdens on

MasterCard and its customers and may lead to increased costs and decreased transaction volumes and revenue.