MasterCard 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

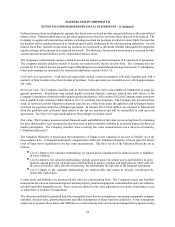

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

67

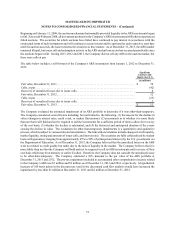

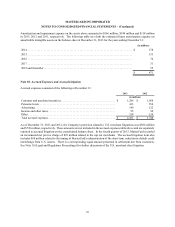

Earnings per share - The Company calculates basic earnings per share ("EPS") by dividing net income by the weighted-

average number of common shares outstanding during the year. Diluted EPS is calculated by dividing net income by

the weighted-average number of common shares outstanding during the year, adjusted for the potentially dilutive effect

of stock options and unvested stock units using the treasury stock method. For the year ended December 31, 2011, the

dilutive effect of stock options is calculated including the effects of certain equity instruments granted in share-based

payment transactions under the two-class method. Unvested share-based payment awards which receive non-forfeitable

dividend rights, or dividend equivalents, are considered participating securities and are required to be included in

computing basic EPS under the two-class method. The Company declared non-forfeitable dividends on unvested

restricted stock units and contingently issuable performance stock units (“Unvested Units”) which were granted prior

to 2009.

Recent accounting pronouncements

Balance sheet offsetting - In January 2013, the Financial Accounting Standards Board ("FASB") issued accounting

guidance clarifying the scope of its previously issued requirements to disclose gross and net amounts of eligible financial

assets and financial liabilities recognized on the balance sheet. The Company adopted the revised accounting guidance

effective January 1, 2013. See Note 20 (Foreign Exchange Risk Management) for additional disclosures related to the

new guidance.

Comprehensive income - In February 2013, new accounting guidance was issued by the FASB that requires disclosure

of amounts reclassified from accumulated other comprehensive income to net income. The Company adopted the

revised accounting guidance effective January 1, 2013. See Note 14 (Accumulated Other Comprehensive Income) for

additional disclosures related to the new guidance.

Foreign currency - In March 2013, the FASB issued clarifying accounting guidance on the release of cumulative

translation adjustment into net income when an entity ceases to have a controlling financial interest in a subsidiary or

a group of assets that is a business within a foreign entity. The Company will adopt the revised accounting guidance

effective January 1, 2014 and does not anticipate that this new accounting guidance will have a material impact on its

consolidated financial statements.

Income taxes - In July 2013, the FASB issued accounting guidance that requires entities to present an unrecognized tax

benefit net with certain deferred tax assets when specific requirements are met. The Company will adopt the revised

accounting guidance effective January 1, 2014 and does not anticipate that this new guidance will have a material

impact on its consolidated financial statements.

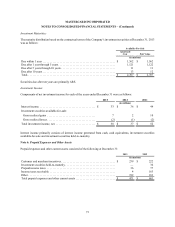

Note 2. Acquisitions

The Company made no acquisitions in 2013. In 2012, the Company completed three acquisitions for an aggregate cost

of $70 million. The excess of purchase consideration over net assets acquired was recorded as goodwill. The goodwill

is not expected to be deductible for local tax purposes.

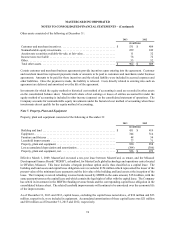

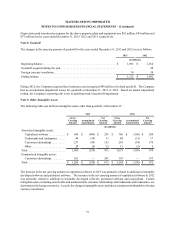

On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program management

operations of Travelex Holdings Ltd., since renamed Access Prepaid Worldwide (“Access”). Pursuant to the terms of

the acquisition agreement, the Company acquired Access on April 15, 2011, at a purchase price of 295 million U.K.

pound sterling, or $481 million, including adjustments for working capital, and contingent consideration (an “earn-

out”) of up to an additional 35 million U.K. pound sterling, or approximately $57 million, based on full year 2011

revenue. The Company recognized a current liability related to the earn-out of 6 million U.K. pound sterling, or

approximately $9 million. The fair value of the earn-out arrangement was estimated by applying a probability-weighted

income approach. The full year revenue for 2011 did not meet the requirements for payment of the earn-out and

therefore the liability was eliminated and the Company recorded other income of $9 million in 2011.

In connection with the acquisition of Access, the Company recognized $6 million of acquisition-related expenses, which

consisted primarily of professional fees related to completing the transaction. These amounts were included in general