MasterCard 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

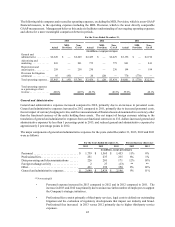

• Data processing and telecommunication expense consists of expenses to support our global

payments network infrastructure, expenses to operate and maintain our computer and

telecommunication system. These expenses vary with business volume growth, system upgrades

and usage.

• Other expenses include loyalty and rewards solutions, travel and entertainment, rental expense

for our facilities, litigation settlements not related to the MDL Provision, investment related

expenses and other miscellaneous operating expenses. The change in other expenses in 2013

compared to 2012 was primarily due to increased costs associated with loyalty and rewards

programs, investment related expenses and increased meeting and travel expenses to support

business and strategy development efforts. The 2012 increase in other expenses versus 2011

was primarily due to increased costs associated with loyalty and rewards programs and the

acquisition of Access Prepaid Worldwide ("Access") in 2011.

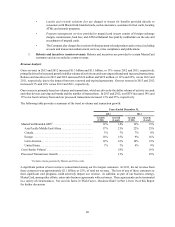

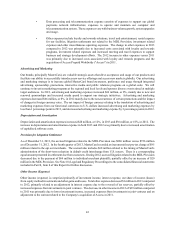

Advertising and Marketing

Our brands, principally MasterCard, are valuable strategic assets that drive acceptance and usage of our products and

facilitate our ability to successfully introduce new service offerings and access new markets globally. Our advertising

and marketing strategy is to increase global MasterCard brand awareness, preference and usage through integrated

advertising, sponsorship, promotions, interactive media and public relations programs on a global scale. We will

continue to invest in marketing programs at the regional and local levels and sponsor diverse events aimed at multiple

target audiences. In 2013, advertising and marketing expenses increased $66 million, or 8%, mainly due to new and

renewed sponsorships and increased media spend to support our strategic initiatives. Advertising and marketing

expenses decreased $66 million, or 8%, in 2012 mainly due to the non-recurrence of certain promotions and the impact

of changes in foreign currency rates. The net impact of foreign currency relating to the translation of advertising and

marketing expenses from our functional currencies to U.S. dollars increased advertising and marketing expenses by

less than 1 percentage point in 2013, and decreased advertising and marketing expense by 3 percentage points in 2012.

Depreciation and Amortization

Depreciation and amortization expenses increased $28 million, or 12%, in 2013 and $36 million, or 18%, in 2012. The

increase in depreciation and amortization expense in both 2013 and 2012 was primarily due to increased amortization

of capitalized software costs.

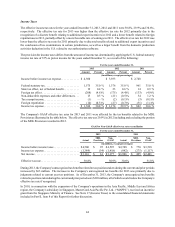

Provision for Litigation Settlement

As of December 31, 2013, the accrued litigation related to the MDL Provision was $886 million versus $726 million

as of December 31, 2012. In the fourth quarter of 2013, MasterCard recorded an incremental net pre-tax charge of $95

million related to the opt out merchants. The accrual also includes $68 million related to the timing of MasterCard's

administration of the short-term reduction in default credit interchange from U.S. issuers. There is a corresponding

equal amount presented in settlement due from customers. During 2012, accrued litigation related to the MDL Provision

decreased due to the payment of $64 million to individual merchant plaintiffs, partially offset by an increase of $20

million in the MDL Provision. See Note 18 (Legal and Regulatory Proceedings) to the consolidated financial statements

included in Part II, Item 8 of this Report for further discussion.

Other Income (Expense)

Other income (expense) is comprised primarily of investment income, interest expense, our share of income (losses)

from equity method investments and other gains and losses. Total other expense decreased $1 million in 2013 compared

to 2012, primarily related to an adjustment in interest expense due to the reversal of tax reserves, partially offset by

increased expenses from investments in joint ventures. The decrease in other income in 2012 of $39 million compared

to 2011 was primarily due to lower investment income, increased expenses from investments in joint ventures and an

adjustment to the earnout related to the Company's acquisition of Access in 2011.