MasterCard 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

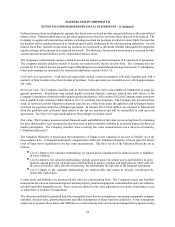

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

62

The Company accounts for investments in common stock or in-substance common stock under the equity method of

accounting when it has the ability to exercise significant influence over the investee, generally when it holds between

20% and 50% ownership in the entity. In addition, investments in flow-through entities such as limited partnerships

and limited liability companies are also accounted for under the equity method when the Company has the ability to

exercise significant influence over the investee, generally when the investment ownership percentage is equal to or

greater than 5% of the outstanding ownership interest. The excess of the cost over the underlying net equity of

investments accounted for under the equity method is allocated to identifiable tangible and intangible assets and liabilities

based on fair values at the date of acquisition. The amortization of the excess of the cost over the underlying net equity

of investments and MasterCard's share of net earnings or losses of entities accounted for under the equity method of

accounting is included in other income (expense) on the consolidated statement of operations.

The Company accounts for investments in common stock or in-substance common stock under the cost method of

accounting when it does not exercise significant influence, generally when it holds less than 20% ownership in the

entity or when the interest in a limited partnership or limited liability company is less than 5% and the Company has

no significant influence over the operation of the investee. Investments in companies that MasterCard does not control,

but that are not in the form of common stock or in-substance common stock, are also accounted for under the cost

method of accounting. Investments for which the equity method or cost method of accounting is used are recorded in

other assets on the consolidated balance sheet.

Use of estimates - The preparation of financial statements in conformity with GAAP requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the

reporting periods. Future events and their effects cannot be predicted with certainty; accordingly, accounting estimates

require the exercise of judgment. The accounting estimates used in the preparation of the Company's consolidated

financial statements may change as new events occur, as more experience is acquired, as additional information is

obtained and as the Company's operating environment changes. Actual results may differ from these estimates.

Revenue recognition - Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred

or services have been rendered, the price is fixed or determinable, and collectibility is reasonably assured. Revenue is

generally derived from transactional information accumulated by our systems or reported by our customers. The

Company's revenue is based on the volume of activity on cards that carry the Company's brands, the number of

transactions processed or the nature of other payment-related products and services.

Volume-based revenue (domestic assessments and cross-border volume fees) is recorded as revenue in the period it is

earned, which is when the related volume is generated on the cards. Certain revenue is based upon information reported

to us by our customers. Transaction-based revenue (transaction processing fees) is calculated by multiplying the number

and type of transactions by their contractual price. Transaction-based fees are recognized as revenue in the same period

as the related transactions occur. Other payment-related products and services are recognized as revenue in the same

period as the related transactions occur or services are rendered.

MasterCard has business agreements with certain customers that provide for rebates or other support when the customers

meet certain volume hurdles as well as other support incentives such as marketing, which are tied to performance.

Rebates and incentives are recorded as a reduction of revenue at the later of (a) when the revenue is recognized by the

Company or (b) at the time the rebate or incentive is offered to the customer. Rebates and incentives are calculated

based upon estimated performance and the terms of the related business agreements. In addition, MasterCard may

make payments to a customer directly related to entering into an agreement, which are deferred and amortized over

the life of the agreement on a straight-line basis.

Business combinations - The Company accounts for business combinations under the acquisition method of accounting.

The Company measures the tangible and intangible identifiable assets acquired, liabilities assumed, and any

noncontrolling interest in the acquiree, at their fair values at the acquisition date. Acquisition-related costs are expensed

as incurred and are included in general and administrative expenses. Any excess of purchase price over the fair value

of net assets acquired, including identifiable intangible assets, is recorded as goodwill.