MasterCard 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

71

The valuation methods for goodwill and other intangible assets involve assumptions concerning comparable company

multiples, discount rates, growth projections and other assumptions of future business conditions. The Company uses

a weighted income and market approach for estimating the fair value of its reporting unit, when necessary. As the

assumptions employed to measure these assets on a nonrecurring basis are based on management's judgment using

internal and external data, these fair value determinations are classified in Level 3 of the Valuation Hierarchy.

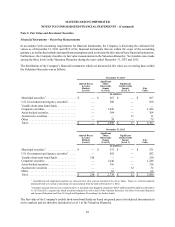

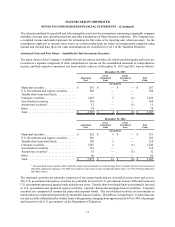

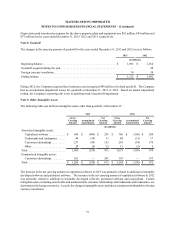

Amortized Costs and Fair Values – Available-for-Sale Investment Securities

The major classes of the Company’s available-for-sale investment securities, for which unrealized gains and losses are

recorded as a separate component of other comprehensive income on the consolidated statement of comprehensive

income, and their respective amortized cost basis and fair values as of December 31, 2013 and 2012 were as follows:

December 31, 2013

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss Fair

Value

(in millions)

Municipal securities. . . . . . . . . . . . . . . . . . . . . . $ 267 $ — $ — $ 267

U.S. Government and Agency securities. . . . . . 560 — — 560

Taxable short-term bond funds . . . . . . . . . . . . . — — — —

Corporate securities . . . . . . . . . . . . . . . . . . . . . . 1,425 2 (1) 1,426

Asset-backed securities . . . . . . . . . . . . . . . . . . . 364 — — 364

Auction rate securities1. . . . . . . . . . . . . . . . . . . 12 — (1) 11

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79 — — 79

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,707 $ 2 $ (2) $ 2,707

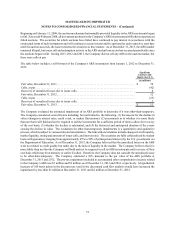

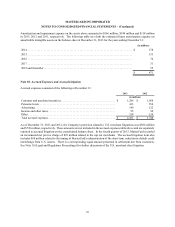

December 31, 2012

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss Fair

Value

(in millions)

Municipal securities. . . . . . . . . . . . . . . . . . . . . . $ 522 $ 9 $ — $ 531

U.S. Government and Agency securities. . . . . . 582 — — 582

Taxable short-term bond funds . . . . . . . . . . . . . 209 1 — 210

Corporate securities . . . . . . . . . . . . . . . . . . . . . . 1,245 2 (1) 1,246

Asset-backed securities . . . . . . . . . . . . . . . . . . . 316 — — 316

Auction rate securities1. . . . . . . . . . . . . . . . . . . 35 — (3) 32

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66 — — 66

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,975 $ 12 $ (4) $ 2,983

1 The unrealized losses related to ARS, which have been in an unrealized loss position longer than 12 months, but have not been deemed

other-than-temporarily impaired. The ARS are included in other assets on the consolidated balance sheet. See Note 6 (Prepaid Expenses

and Other Assets).

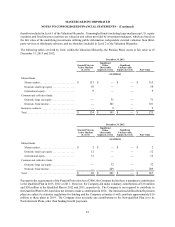

The municipal securities are primarily comprised of tax-exempt bonds and are diversified across states and sectors.

The U.S. government and agency securities are primarily invested in U.S. government treasury bills and bonds and

U.S. government sponsored agency bonds and discount notes. Taxable short-term bond funds were primarily invested

in U.S. government and sponsored agency securities, corporate bonds and mortgage-backed securities. Corporate

securities are comprised of commercial paper and corporate bonds. The asset-backed securities are investments in

bonds which are collateralized primarily by automobile loan receivables. The ARS are exempt from U.S. federal income

tax and are fully collateralized by student loans with guarantees (ranging from approximately 95% to 98% of principal

and interest) by the U.S. government via the Department of Education.