MasterCard 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

65

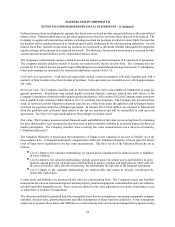

internal and external data, these fair value determinations are classified in Level 3 of the Valuation Hierarchy. The

Company has not elected to apply the fair value option to its eligible financial assets and liabilities.

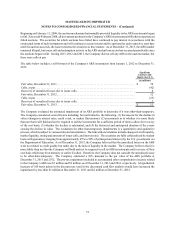

Investment securities - The Company classifies investments in debt securities as held-to-maturity or available-for-sale

and classifies investments in equity securities as available-for-sale or trading, if a readily available fair value can be

determined. Available-for-sale securities that are available to meet the Company's current operational needs are

classified as current assets. Available-for-sale securities that are not available to meet the Company's current operational

needs are classified as non-current assets.

Investments in debt securities are classified as held-to-maturity when the Company has the intent and ability to hold

the debt securities to maturity and are stated at amortized cost. Investments in debt securities not classified as held-

to-maturity are classified as available-for-sale and are carried at fair value, with unrealized gains and losses, net of

applicable taxes, recorded as a separate component of other comprehensive income on the consolidated statement of

comprehensive income. Net realized gains and losses on debt securities are recognized in investment income on the

consolidated statement of operations.

Investments in equity securities classified as available-for-sale are carried at fair value, with unrealized gains and losses,

net of applicable taxes, recorded as a separate component of other comprehensive income on the consolidated statement

of comprehensive income. Net realized gains and losses on available-for-sale equity securities are recognized in

investment income on the consolidated statement of operations. The specific identification method is used to determine

realized gains and losses.

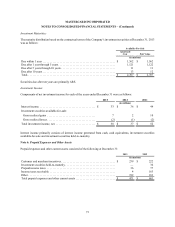

Derivative financial instruments - The Company records all derivatives at fair value in other assets and other liabilities

on the consolidated balance sheet. The Company's foreign exchange forward contracts are included in Level 2 of the

Valuation Hierarchy as the fair value of these contracts are based on broker quotes for the same or similar instruments.

Changes in the fair value of derivative instruments are reported in current-period earnings. The Company did not have

any derivative contracts accounted for under hedge accounting as of December 31, 2013 and 2012.

Settlement due from/due to customers - The Company operates systems for clearing and settling payment transactions

among MasterCard customers. Net settlements are generally cleared daily among customers through settlement cash

accounts by wire transfer or other bank clearing means. However, some transactions may not settle until subsequent

business days, resulting in amounts due from and due to MasterCard customers.

Restricted security deposits held for MasterCard customers - MasterCard requires collateral from certain customers

for settlement of their transactions. The majority of collateral for settlement is in the form of standby letters of credit

and bank guarantees which are not recorded on the balance sheet. Additionally, MasterCard holds cash deposits and

certificates of deposit from certain customers of MasterCard as collateral for settlement of their transactions. These

assets are fully offset by corresponding liabilities included on the consolidated balance sheet.

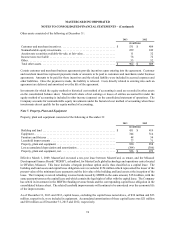

Property, plant and equipment - Property, plant and equipment are stated at cost less accumulated depreciation and

amortization. Depreciation and amortization is computed using the straight-line method over the estimated useful lives

of the assets. Depreciation of leasehold improvements and amortization of capital leases is included in depreciation

and amortization expense.

The useful lives of the Company's assets are as follows:

Asset Category Estimated Useful Life

Buildings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Furniture and fixtures and equipment. . . . . . . . . 2 - 5 years

Leasehold improvements . . . . . . . . . . . . . . . . . . Shorter of life of improvement or lease term

Capital leases. . . . . . . . . . . . . . . . . . . . . . . . . . . . Lease term