Lexmark 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

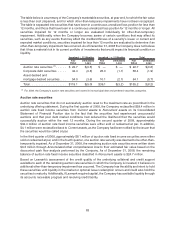

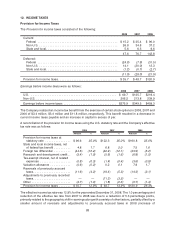

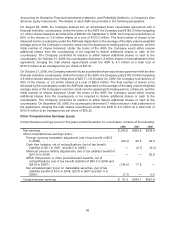

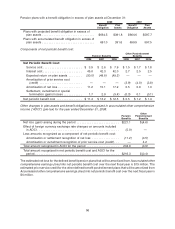

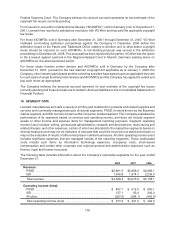

Accumulated other comprehensive (loss) earnings for the years ended December 31 consists of the

following:

Foreign

Currency

Translation

Adjustment

Cash Flow

Hedges

Minimum

Pension

Liability

Pension or

Other

Postretirement

Benefits

Net Unrealized

(Loss) Gain on

Marketable

Securities

Accumulated

Other

Comprehensive

(Loss) Earnings

Balance at 12/31/05 . . . . . . $(15.2) $ 7.1 $(154.6) $ — $(0.6) $(163.3)

2006 Change. . . . . . . . . . 22.3 (6.4) 26.9 — 0.6 43.4

Adoption of SFAS 158 . . . — — 127.7 (138.7) — (11.0)

Balance at 12/31/06 . . . . . . 7.1 0.7 — (138.7) — (130.9)

2007 Change. . . . . . . . . . 22.5 (0.7) — 17.5 — 39.3

Balance at 12/31/07 . . . . . . $ 29.6 $ — $ — $(121.2) $ — $ (91.6)

2008 Change. . . . . . . . . . (63.4) — — (124.0) (1.3) (188.7)

Balance at 12/31/08 . . . . . . $(33.8) $ — $ — $(245.2) $(1.3) $(280.3)

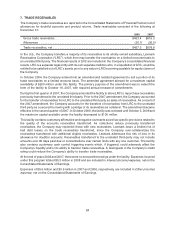

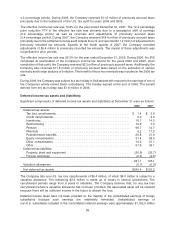

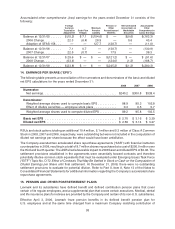

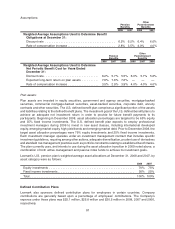

14. EARNINGS PER SHARE (“EPS”)

The following table presents a reconciliation of the numerators and denominators of the basic and diluted

net EPS calculations for the years ended December 31:

2008 2007 2006

Numerator:

Net earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $240.2 $300.8 $338.4

Denominator:

Weighted average shares used to compute basic EPS . . . . . . . . . . . 88.9 95.3 102.8

Effect of dilutive securities — employee stock plans . . . . . . . . . . . . . 0.3 0.5 0.7

Weighted average shares used to compute diluted EPS . . . . . . . . . . 89.2 95.8 103.5

Basic net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.70 $ 3.16 $ 3.29

Diluted net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.69 $ 3.14 $ 3.27

RSUs and stock options totaling an additional 10.4 million, 5.1 million and 5.3 million of Class A Common

Stock in 2008, 2007 and 2006, respectively, were outstanding but were not included in the computation of

diluted net earnings per share because the effect would have been antidilutive.

The Company executed two accelerated share repurchase agreements (“ASR”) with financial institution

counterparties in 2008, resulting in a total of 8.7 million shares repurchased at a cost of $250.0 million over

the third and fourth quarter. The ASRs had a favorable impact to 2008 basic and diluted EPS of $0.06. The

settlement provisions established in the agreements were essentially forward contracts and therefore

potentially dilutive common stock equivalents that must be evaluated under Emerging Issues Task Force

(“EITF”) Topic No. D-72 Effect of Contracts That May Be Settled in Stock or Cash on the Computation of

Diluted Earnings per Share until final settlement. At December 31, 2008, there were no outstanding

settlement provisions to evaluate for potential dilution. Refer to Part II, Item 8, Note 13 of the Notes to

Consolidated Financial Statements for additional information regarding the Company’s accelerated share

repurchase agreements.

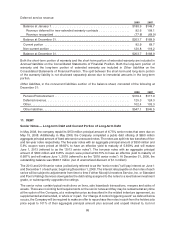

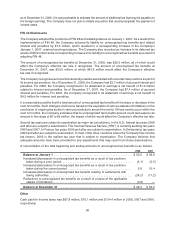

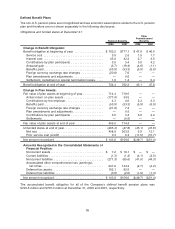

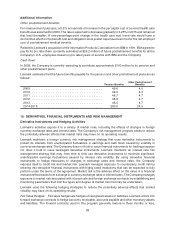

15. PENSION AND OTHER POSTRETIREMENT PLANS

Lexmark and its subsidiaries have defined benefit and defined contribution pension plans that cover

certain of its regular employees, and a supplemental plan that covers certain executives. Medical, dental

and life insurance plans for retirees are provided by the Company and certain of its non-U.S. subsidiaries.

Effective April 3, 2006, Lexmark froze pension benefits in its defined benefit pension plan for

U.S. employees and at the same time changed from a maximum Company matching contribution of

93