Lexmark 2008 Annual Report Download - page 88

Download and view the complete annual report

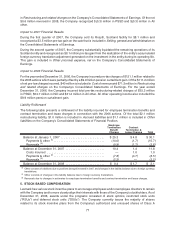

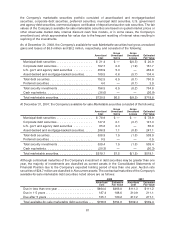

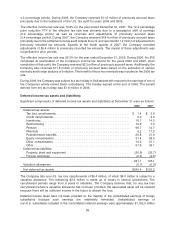

Please find page 88 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Proceeds from the sales and maturities of the Company’s available-for-sale marketable securities were

$533.8 million in 2008, $855.3 million in 2007 and $1,721.0 million in 2006. For the year ended

December 2008, the Company recognized $7.9 million in net losses on its marketable securities, of

which $7.3 million was recognized as other-than-temporary impairment and $0.6 million was net realized

losses. The realized gains and losses in 2007 and 2006 were immaterial. The Company uses the specific

identification method when accounting for the costs of its available-for-sale marketable securities sold.

Impairment

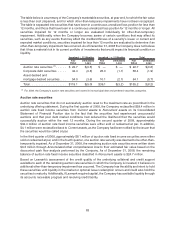

The Company assesses its marketable securities for other-than-temporary declines in value by

considering several factors that include, among other things, any events that may affect the

creditworthiness of a security’s issuer, current and expected market conditions, the length of time and

extent to which fair value is less than cost, and the Company’s ability and intent to hold the security until a

forecasted recovery of fair value that may include holding the security to maturity.

Market conditions continue to indicate significant uncertainty on the part of investors on the economic

outlook for the U.S. and for financial institutions. This uncertainty has created reduced liquidity across the

fixed income investment market, including the securities in which Lexmark is invested. As a result, some of

the Company’s investments have experienced reduced liquidity including unsuccessful auctions for its

auction rate security holdings as well as temporary and other than temporary impairment of other

marketable securities.

In 2008 there were several significant market events, including the bankruptcy of Lehman Brothers

Holdings and the failure of many auction rate securities. In 2008, Lexmark recognized, based on indicative

pricing, charges of $4.4 million for other-than-temporary impairment of its Lehman Brothers corporate debt

securities, and $1.0 million for other-than-temporary impairment related to distressed corporate debt,

mortgage-backed and asset-backed securities. Additionally in 2008, the Company recognized a

$1.9 million charge for other-than-temporary impairment in connection with its auction rate fixed

income securities; the fair value of which was determined using an internal discount cash flow

valuation model. All charges for other-than-temporary impairment are recognized in Other (income)

expense, net on the Consolidated Statements of Earnings. In addition, the Company has recognized a

cumulative, pre-tax valuation allowance of $1.7 million included in Accumulated other comprehensive loss

on the Consolidated Statements of Financial Position, representing a temporary impairment of the overall

portfolio.

82