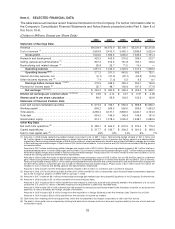

Lexmark 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lexmark continues to maintain a strong financial position with good cash generation and a solid balance

sheet, which positions it to prudently invest in the future of the business and successfully compete even

during challenging times.

2008 Business Factors

PSSD

During 2008, Lexmark continued its investments in PSSD through new products and technology. The

Company expects these investments to produce a steady stream of new products. Lexmark continued to

strengthen its customer value propositions with the introduction of over 40 new laser products in 2008 that

significantly strengthened the Company’s monochrome laser line, color laser line and laser MFPs.

The Company continued its investment in the expansion of managed print services and Lexmark also

made investments to improve its coverage and expand the reach of its solutions and services proposition.

The focus of all of these PSSD investments is to drive workgroup laser growth and page generation.

ISD

Lexmark believes it is experiencing shrinkage in its installed base of inkjet products and an associated

decline in end-user demand for inkjet supplies. The Company sees the potential for continued erosion in

end-user inkjet supplies demand due to the reduction in inkjet hardware unit sales resulting from the

Company’s decision to focus on more profitable printer placements and the weakness the Company is

experiencing in its OEM business. Additionally, Lexmark expects to see continued declines in OEM unit

sales and aggressive pricing and promotion activities in the inkjet market. However, Lexmark did

experience a 13% increase in its average unit revenue (“AUR”) for inkjet products in 2008 that reflects

the Company’s efforts to move to higher priced, higher usage inkjet devices. Additionally, the Company

advanced its inkjet product line in 2008 with the introduction of additional new wireless models and the

Company’s Professional Series inkjet models.

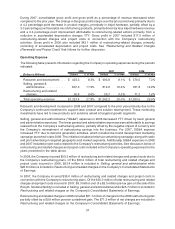

Overall in 2008, the weakening of the global economy significantly impacted the Company’s revenue.

Additionally, Lexmark’s inkjet strategy transition to higher usage customers and products also significantly

impacted the Company’s inkjet unit sales and supplies revenue. However, the Company continues to

invest in its core print technologies and product development that is expected to drive a strong pipeline of

future Lexmark products.

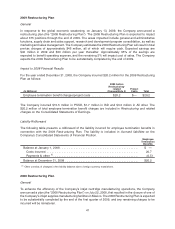

In response to the global economic weakening and to enhance the efficiency of the Company’s inkjet

cartridge manufacturing operations, Lexmark announced restructuring actions in January 2009 and July

2008 that affected the Company’s operating results in 2008. See “Restructuring and Related Charges

(Reversals) and Project Costs” that follows for further discussion.

2007 Business Factors

Beginning in the second quarter of 2007, the Company experienced the following issues in ISD:

• On-going declines in inkjet supplies and OEM unit sales.

• Lower average unit revenues due to aggressive pricing and promotion.

• Additional costs in its new products.

As the Company analyzed the situation, it saw the following:

• Some of its unit sales were not generating adequate lifetime profitability due to lower prices, higher

costs and supplies usage below its model.

• Some markets and channels were on the low-end of the supplies generation distribution curve.

33