Lexmark 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

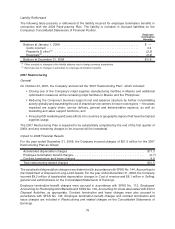

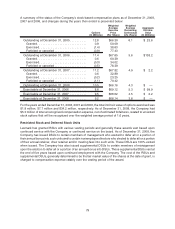

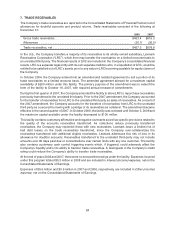

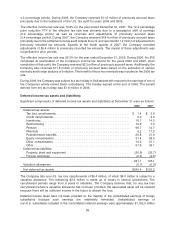

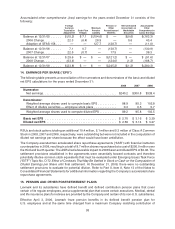

8. INVENTORIES

Inventories consisted of the following at December 31:

2008 2007

Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $102.4 $127.2

Finished goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 335.9 337.2

Inventories. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $438.3 $464.4

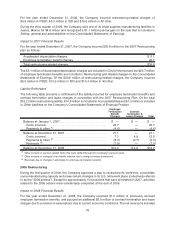

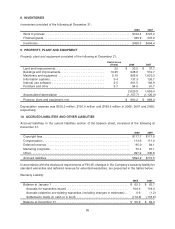

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following at December 31:

Useful Lives

(Years) 2008 2007

Land and improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 $ 33.2 $ 37.7

Buildings and improvements. . . . . . . . . . . . . . . . . . . . . . . . . . 10-35 528.6 512.7

Machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-10 965.8 1,023.3

Information systems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-4 137.3 136.7

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-5 261.5 192.9

Furniture and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-7 94.5 91.7

2,020.9 1,995.0

Accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,157.7) (1,126.0)

Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . $ 863.2 $ 869.0

Depreciation expense was $203.2 million, $191.0 million and $199.5 million in 2008, 2007 and 2006,

respectively.

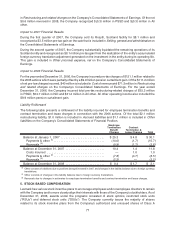

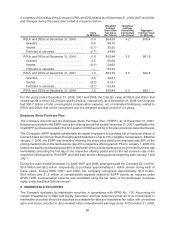

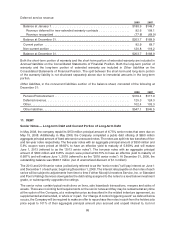

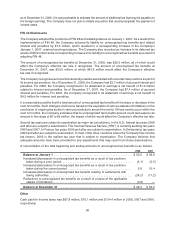

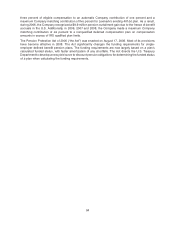

10. ACCRUED LIABILITIES AND OTHER LIABILITIES

Accrued liabilities, in the current liabilities section of the balance sheet, consisted of the following at

December 31:

2008 2007

Copyright fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $117.7 $117.5

Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114.6 111.0

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95.0 84.1

Marketing programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70.4 67.1

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 297.2 330.8

Accrued liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $694.9 $710.5

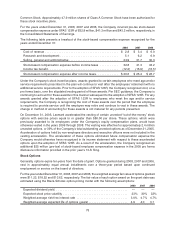

In accordance with the disclosure requirements of FIN 45, changes in the Company’s warranty liability for

standard warranties and deferred revenue for extended warranties, are presented in the tables below:

Warranty Liability:

2008 2007

Balance at January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 62.3 $ 62.7

Accruals for warranties issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.6 119.4

Accruals related to pre-existing warranties (including changes in estimates) . . 0.6 (1.2)

Settlements made (in cash or in kind) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (112.6) (118.6)

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 50.9 $ 62.3

85