Lexmark 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2008, the FASB issued FSP No. EITF 03-6-1, Determining Whether Instruments Granted in Share-

Based Payment Transactions Are Participating Securities (“FSP EITF 03-6-1”). The FASB concluded in

this FSP that unvested share-based payment awards that contain nonforfeitable rights to dividends or

dividend equivalents are participating securities and shall be included in the calculation of earnings per

share pursuant to the two-class method. This FSP is effective for financial statements issued for fiscal

years beginning after December 15, 2008, requiring all prior-period earnings per share data presented to

be adjusted retrospectively. The Company does not expect FSP EITF 03-6-1 to have a material impact on

its calculation of earnings per share.

In December 2008, the FASB issued FSP No. FAS 132(R)-1, Employers’ Disclosures about Postretirement

Benefit Plan Assets. The FSP amends the disclosure requirements of FAS 132(R) Employers’ Disclosures

about Pensions and Other Postretirement Benefit to provide additional transparencies regarding the

assets held by retirement plans and their associated risks. The FSP also requires employers to disclose

information about the fair value measurements of plan assets in a similar manner to the disclosures

currently required by FASB No. 157, Fair Value Measurements. The additional disclosures are effective for

financial statements issued for fiscal years ending after December 15, 2009. The Company is currently

evaluating the impact of the disclosure requirements of this FSP.

Reclassifications:

Certain prior year amounts have been reclassified, if applicable, to conform to the current presentation.

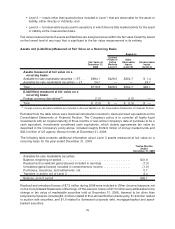

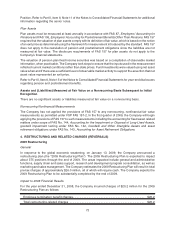

3. FAIR VALUE

General

The Company adopted the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 157,

Fair Value Measurements (“FAS 157”) effective January 1, 2008. FAS 157 defines fair value, establishes a

framework for measuring fair value in generally accepted accounting principles (“GAAP”) and expands

disclosures about fair value measurements. The standard defines fair value as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. As part of the framework for measuring fair value, FAS 157 establishes a

hierarchy of inputs to valuation techniques used in measuring fair value that maximizes the use of

observable inputs and minimizes the use of unobservable inputs by requiring that the most observable

inputs be used when available.

The Company has not applied the provisions of FAS 157 to any nonrecurring, nonfinancial fair value

measurements as permitted under Financial Accounting Standards Board (“FASB”) Staff Position

No. 157-2 (“FSP FAS 157-2”). Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial

Statements for additional information regarding FSP FAS 157-2. The Company is in the process of

evaluating the inputs and techniques used in these measurements, including such items as impairment

assessments of fixed assets, initial recognition of asset retirement obligations, and goodwill impairment

testing.

The provisions of FASB Staff Position No. 157-3 (“FSP FAS 157-3”) Determining the Fair Value of a

Financial Asset When the Market for That Asset Is Not Active, issued October 10, 2008, were also

considered in preparation of the year end 2008 financial statements. Refer to Part II, Item 8, Note 2 of the

Notes to Consolidated Financial Statements for additional information regarding FSP FAS 157-3.

Fair Value Hierarchy

The three levels of the fair value hierarchy under FAS 157 are:

• Level 1 — Quoted prices (unadjusted) in active markets for identical, unrestricted assets or

liabilities that the Company has the ability to access at the measurement date;

69