Lexmark 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

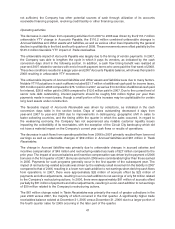

Impacts to 2007 Financial Results

For the year ended December 31, 2007, the Company incurred charges of $34.2 million for the 2007

Restructuring Plan as follows:

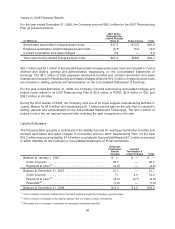

(In Millions)

2007 Action

Restructuring-

related

Charges (Note 4) Project Costs Total

Accelerated depreciation charges/project costs . . . . . . . . . . $ 5.1 $0.8 $ 5.9

Employee termination benefit charges/project costs . . . . . . 25.7 2.6 28.3

Total restructuring-related charges/project costs . . . . . . . . . $30.8 $3.4 $34.2

The Company incurred $5.9 million of accelerated depreciation charges and project costs in Cost of

revenue on the Consolidated Statements of Earnings. $25.7 million of total employee termination benefit

charges are included in Restructuring and related charges while $2.6 million of related project costs are

included in Selling, general and administrative on the Consolidated Statements of Earnings.

For the year ended December 31, 2007, the Company incurred restructuring and related charges and

project costs of $6.4 million in PSSD, $14.9 million in ISD and $12.9 million in All other.

2006 Restructuring Plan

During the first quarter of 2006, the Company approved a plan to restructure its workforce, consolidate

manufacturing capacity and make certain changes to its U.S. retirement plans (collectively referred to as

the “2006 actions”). Except for approximately 100 positions that were eliminated in 2007, activities related

to the 2006 actions were substantially completed at the end of 2006.

Impact to 2008 Financial Results

For the year ended December 31, 2008, the Company reversed $1.5 million of previously accrued

employee termination benefits and accrued an additional $0.9 million of contract termination and lease

charges due to a revision in assumptions based on current economic conditions. The net reversal is

included in Restructuring and related charges on the Company’s Consolidated Statements of Earnings. Of

the net $0.6 million reversed in 2008, the Company recognized $(0.3) million in PSSD and $(0.3) million in

All other.

Impact to 2007 Financial Results

During the first quarter of 2007, the Company sold its Rosyth, Scotland facility for $8.1 million and

recognized a $3.5 million pre-tax gain on the sale that is included in Selling, general and administrative on

the Consolidated Statements of Earnings.

During the second quarter of 2007, the Company substantially liquidated the remaining operations of its

Scotland entity and recognized an $8.1 million pre-tax gain from the realization of the entity’s accumulated

foreign currency translation adjustment generated on the investment in the entity during its operating life.

This gain is included in Other (income) expense, net on the Company’s Consolidated Statements of

Earnings.

For the year ended December 31, 2007, the Company incurred approximately $17.8 million of project

costs related to the Company’s 2006 actions. The $17.8 million of project costs is the net amount incurred

after including the gain recognized on the sale of the Rosyth, Scotland facility during the first quarter of

2007. Of the $17.8 million of 2006 project costs incurred, $11.1 million is included in Cost of revenue and

$6.7 million in Selling, general and administrative on the Company’s Consolidated Statements of Earnings.

For the year ended December 31, 2007, the Company incurred total pre-tax 2006 project costs of

$5.7 million in PSSD and $14.8 million in All other, while ISD realized a $2.7 million net benefit after the sale

of the Rosyth, Scotland facility.

44