Lexmark 2008 Annual Report Download - page 68

Download and view the complete annual report

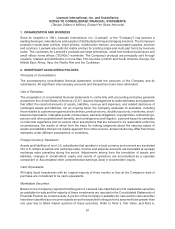

Please find page 68 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketable Securities, for further discussion on the Company’s auction rate securities. Lexmark reports its

available-for-sale marketable securities at fair value with unrealized gains or losses recorded in

Accumulated other comprehensive earnings (loss) on the Consolidated Statements of Financial

Position. The Company assesses its marketable securities for other-than-temporary declines in value

by considering various factors that include, among other things, any events that may affect the

creditworthiness of a security’s issuer, the length of time the security has been in a loss position and

the Company’s ability and intent to hold the security until a forecasted recovery of fair value that may

include holding the security to maturity. Realized gains or losses are included in net earnings in Other

(income) expense, net on the Consolidated Statements of Earnings and are derived using the specific

identification method for determining the cost of the securities.

Allowance for Doubtful Accounts:

Lexmark maintains allowances for doubtful accounts for estimated losses resulting from the inability of its

customers to make required payments. The Company estimates the allowance for doubtful accounts

based on a variety of factors including the length of time receivables are past due, the financial health of its

customers, unusual macroeconomic conditions and historical experience. If the financial condition of its

customers deteriorates or other circumstances occur that result in an impairment of customers’ ability to

make payments, the Company records additional allowances as needed.

Fair Value:

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at the measurement date. In measuring fair

value, the Company uses a hierarchy of inputs to valuation techniques that maximizes the use of

observable inputs and minimizes the use of unobservable inputs by requiring that the most observable

inputs be used when available. Although permitted under current accounting guidance, the Company has

not applied fair value measurements to any nonrecurring, nonfinancial fair value items such as impairment

assessments of fixed assets, initial recognition of asset retirement obligations, and goodwill impairment

testing.

The Company generally uses a market approach, when practicable, in valuing financial instruments. In

certain instances, when observable market data is lacking, the Company uses valuation techniques

consistent with the income approach whereby future cash flows are converted to a single discounted

amount. The fair value of cash and cash equivalents, trade receivables, trade payables and short-term

debt approximates their carrying values due to the relatively short-term nature of the instruments. The fair

value of Lexmark’s marketable securities are based on quoted market prices or other observable market

data or in some cases, internally developed inputs and assumptions (discounted cash flow model) when

observable market data does not exist. The fair value of long-term debt, as well as the previous year’s

current portion of long-term debt, is/was estimated based on current rates available to the Company for

debt with similar characteristics. The fair value of derivative financial instruments is based on pricing

models or formulas using current market data, or where applicable, quoted market prices.

Inventories:

Inventories are stated at the lower of average cost or market, using standard cost which approximates the

average cost method of valuing its inventories and related cost of goods sold. The Company considers all

raw materials to be in production upon their receipt.

Lexmark writes down its inventory for estimated obsolescence or unmarketable inventory equal to the

difference between the cost of inventory and the estimated market value. The Company estimates the

difference between the cost of obsolete or unmarketable inventory and its market value based upon

product demand requirements, product life cycle, product pricing and quality issues. Also, Lexmark

records an adverse purchase commitment liability when anticipated market sales prices are lower than

committed costs.

62