Lexmark 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

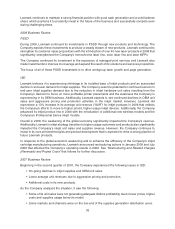

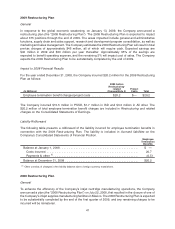

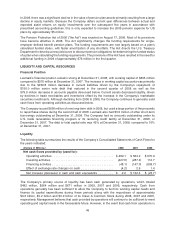

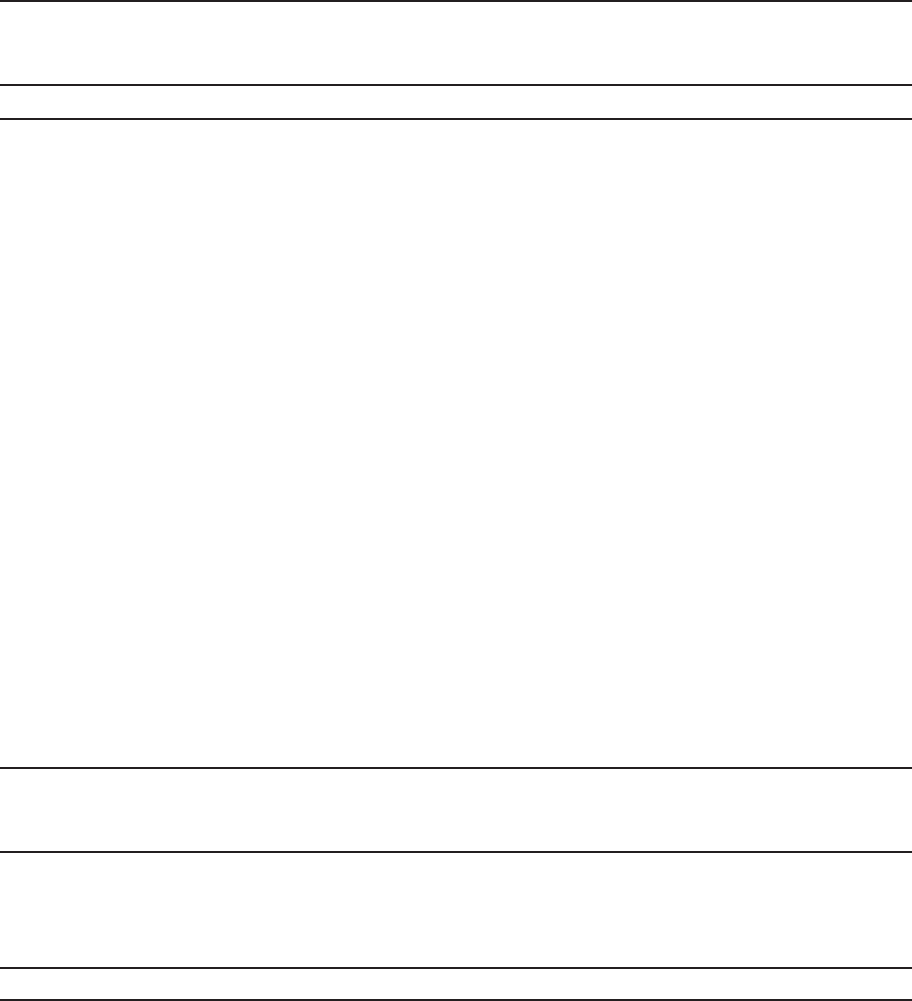

Impact to 2008 Financial Results

For the year ended December 31, 2008, the Company incurred $50.3 million for the 2007 Restructuring

Plan as presented below:

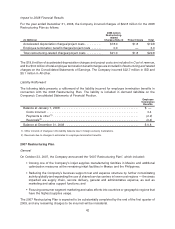

(In Millions)

2007 Action

Restructuring-

related Charges

(Note 4) Project Costs Total

Accelerated depreciation charges/project costs . . . . . . . . . . $17.3 $13.5 $30.8

Employee termination benefit charges/project costs . . . . . . . (0.7) 15.3 14.6

Contract termination and lease charges . . . . . . . . . . . . . . . . 4.9 — 4.9

Total restructuring-related charges/project costs . . . . . . . . . . $21.5 $28.8 $50.3

$22.7 million and $8.1 million of accelerated depreciation charges and project costs are included in Cost of

revenue and Selling, general and administrative, respectively, on the Consolidated Statements of

Earnings. The $4.2 million of total employee termination benefits and contract termination and lease

charges are included in Restructuring and related charges while the $15.3 million of related project costs

are included in Selling, general and administrative on the Consolidated Statements of Earnings.

For the year ended December 31, 2008, the Company incurred restructuring and related charges and

project costs related to its 2007 Restructuring Plan of $9.2 million in PSSD, $2.9 million in ISD, and

$38.2 million in All other.

During the third quarter of 2008, the Company sold one of its inkjet supplies manufacturing facilities in

Juarez, Mexico for $4.6 million and recognized a $1.1 million pre-tax gain on the sale that is included in

Selling, general and administrative on the Consolidated Statements of Earnings. The $15.3 million of

project costs is the net amount incurred after including the gain recognized on the sale.

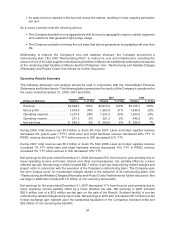

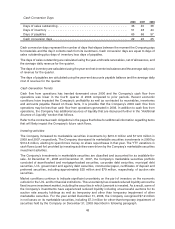

Liability Rollforward

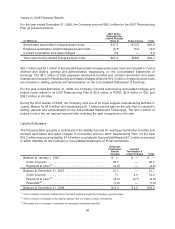

The following table presents a rollforward of the liability incurred for employee termination benefits and

contract termination and lease charges in connection with the 2007 Restructuring Plan. Of the total

$16.2 million restructuring liability, $14.9 million is included in Accrued liabilities and $1.3 million is included

in Other liabilities on the Company’s Consolidated Statements of Financial Position.

Employee

Termination

Benefit

Charges

Contract

Termination &

Lease Charges Total

Balance at January 1, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ —

Costs incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.7 — 25.7

Payments & other

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.6) — (4.6)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . 21.1 — 21.1

Costs incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.1 4.9 12.0

Payments & other

(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8.3) (0.7) (9.0)

Reversals

(3)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.9) — (7.9)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . $12.0 $ 4.2 $16.2

1)

Other consists of pension related items that were settled through the Company’s pension plans.

2)

Other consists of changes in the liability balance due to foreign currency translations.

3)

Reversals due to changes in estimates for employee termination benefits.

43