Lexmark 2008 Annual Report Download - page 77

Download and view the complete annual report

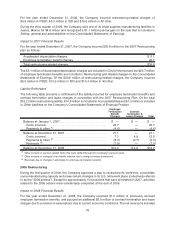

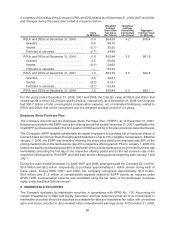

Please find page 77 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Transfers in to Level 3 during the year included Lehman Brothers corporate debt securities which were

subsequently written down in the third quarter of 2008 based on indicative pricing as indicated in the

preceding paragraph as well as various other securities for which current, observable market data was no

longer available due to specific credit events or a general decrease in trading activity. These transfers in

were offset partially by transfers out of Level 3, into Level 2, due to notification of certain auction rate

securities being called at par in the second quarter of 2008. Settlement of these securities occurred in third

quarter of 2008. The Company assesses the facts and circumstances at each quarterly reporting date

regarding securities that have been measured using significant unobservable inputs and categorized as

Level 3.

Interest rate swap contracts, which served as a fair value hedge of the Company’s senior notes that

matured in May 2008, were also considered a Level 3 fair value measurement. Because the short-cut

method of FAS 133 was used to record the fair value of the interest rate swaps, the Company believes it is

clearer to describe the activity in narrative form rather than to include the change in fair value in the

Level 3 year to date rollforward above. The fair values of the interest rate swaps at December 31, 2007 and

March 31, 2008 were assets of $0.1 million and $0.3 million, respectively. Final settlement occurred in May

2008, resulting in net cash proceeds of $0.8 million. As of December 31, 2008, the Company has not

entered into any new interest rate swap contracts.

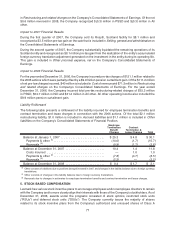

Valuation Techniques

The Company generally uses a market approach, when practicable, in valuing the following financial

instruments. In certain instances, when observable market data is lacking, the Company uses valuation

techniques consistent with the income approach whereby future cash flows are converted to a single

discounted amount.

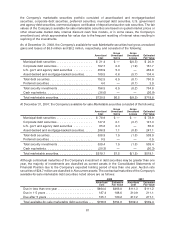

Marketable Securities

The Company evaluates its marketable securities in accordance with SFAS No. 115, Accounting for

Certain Investments in Debt and Equity Securities, and has determined that all of its investments in

marketable securities should be classified as available-for-sale and reported at fair value. The fair values of

the Company’s available-for-sale marketable securities are based on quoted market prices or other

observable market data, or in some cases, internally developed inputs and assumptions such as

discounted cash flow models or indicative pricing sources, when observable market data does not

exist. The Company uses a third party to provide the fair values of the securities in which Lexmark is

invested. However, in limited instances, the Company has adjusted the fair values provided by the third

party service provider in order to better reflect the risk adjustments that market participants would make for

nonperformance and liquidity risks.

Level 1 fair value measurements are based on quoted market prices in active markets and include

U.S. government and agency securities. These valuations are performed using a consensus price method,

whereby prices from a variety of industry data providers are input into a distribution-curve based algorithm

to determine daily market values.

Level 2 fair value measurements are based on quoted prices in markets that are not active, broker dealer

quotations, or other methods by which all significant inputs are observable, either directly or indirectly.

Securities utilizing Level 2 inputs are primarily corporate bonds, asset-backed securities and mortgage-

backed securities, all of which are valued using the consensus price method described previously. Level 2

fair value measurements also include smaller amounts of commercial paper and certificates of deposit

which generally have shorter maturities and less frequent market trades. Such securities are valued via

mathematical calculations using observable inputs until such time that market activity reflects an updated

price.

Level 3 fair value measurements are based on inputs that are unobservable and significant to the overall

valuation. Level 3 fair value measurements include security types that do not have readily determinable

market values and/or are not priced by independent data sources, including auction rate securities for

71