Lexmark 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

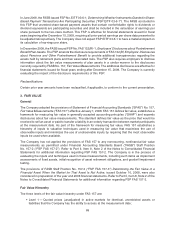

• Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or

liability, either directly or indirectly; and

• Level 3 — Unobservable inputs used in valuations in which there is little market activity for the asset

or liability at the measurement date.

Fair value measurements of assets and liabilities are assigned a level within the fair value hierarchy based

on the lowest level of any input that is significant to the fair value measurement in its entirety.

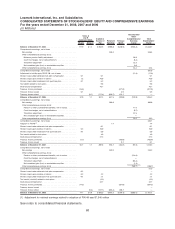

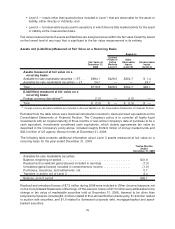

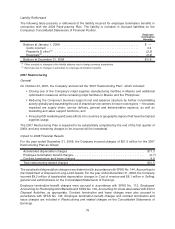

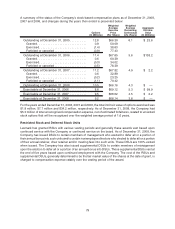

Assets and (Liabilities) Measured at Fair Value on a Recurring Basis

Fair Value at

December 31,

2008

Quoted

Prices in

Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Based on

Assets measured at fair value on a

recurring basis:

Available-for-sale marketable securities — ST. . . $694.1 $428.0 $264.7 $ 1.4

Available-for-sale marketable securities — LT. . 24.7 — — 24.7

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $718.8 $428.0 $264.7 $26.1

(Liabilities) measured at fair value on a

recurring basis:

Foreign currency derivatives

(1)

. . . . . . . . . . . . . (1.5) — (1.5) —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.5) $ — $ (1.5) $ —

(1)

Foreign currency derivative liabilities are included in Accrued liabilities on the Consolidated Statements of Financial Position.

Excluded from the table above were financial instruments included in Cash and cash equivalents on the

Consolidated Statements of Financial Position. The Company’s policy is to consider all highly liquid

investments with an original maturity of three months or less at the Company’s date of purchase to be a

cash equivalent. Investments considered cash equivalents, which closely approximate fair value as

described in the Company’s policy above, included roughly $129.9 million of money market funds and

$36.0 million of US agency discount notes at December 31, 2008.

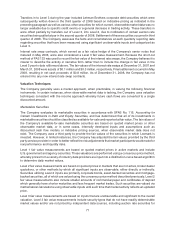

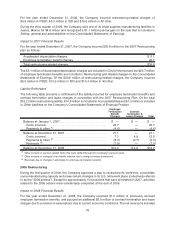

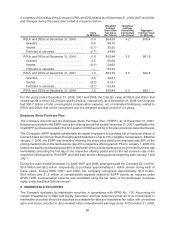

The following table presents additional information about Level 3 assets measured at fair value on a

recurring basis for the year ended December 31, 2008:

Twelve Months

Ended

December 31, 2008

Available-for-sale marketable securities

Balance, beginning of period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $31.9

Realized and unrealized gains/(losses) included in earnings . . . . . . . . . . . . . . . . . (7.3)

Unrealized gains/(losses) included in comprehensive income . . . . . . . . . . . . . . . . (1.0)

Purchases, issuances, and settlements, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1

Transfers in and/or out of Level 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.4

Balance, end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $26.1

Realized and unrealized losses of $7.3 million during 2008 were included in Other (income) expense, net

on the Consolidated Statements of Earnings. Of this amount, losses of $7.3 million were attributable to the

change in fair value of marketable securities held at December 31, 2008, deemed to be other than

temporarily impaired, including $4.4 million related to the Lehman Brothers bankruptcy, $1.9 million related

to auction rate securities, and $1.0 related to distressed corporate debt, mortgage-backed and asset-

backed securities.

70