Lexmark 2008 Annual Report Download - page 56

Download and view the complete annual report

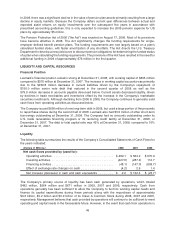

Please find page 56 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adjusted the fair values provided by the third party in order to better reflect the risk adjustments that market

participants would make for nonperformance and liquidity risks. Level 3 fair value measurements are

based on inputs that are unobservable and significant to the overall valuation. The Company’s Level 3

recurring fair value measurements include security types that do not have readily determinable market

values and/or are not priced by independent data sources, including failed auction rate securities valued at

$24.7 million (discussed previously), certain distressed debt instruments valued at $0.8 million (including

Lehman corporate debt valued at $0.5 million) and other thinly traded corporate debt securities and

mortgage-backed securities valued at $0.6 million. These measurements were roughly 3.6% of the

Company’s total available-for-sale marketable securities portfolio.

The discounted cash flow analysis performed by the Company on its auction rate securities at year-end

2008 used current coupon rates, a first quarter 2010 redemption date and a 50 basis point liquidity

premium factored into the discount rate. The result was the Company’s best estimate of fair value using

assumptions that the Company believes market participants would make for nonperformance and liquidity

risk at the measurement date. For certain debt instruments that the Company considers distressed due to

reasons such as bankruptcy or a significant downgrade in credit rating, the securities are generally valued

using non-binding quotes from brokers or other indicative pricing sources. For certain corporate debt and

mortgage-backed securities held by the Company, current pricing data was no longer available at the

measurement date, representing a decline in the volume and level of trading activity. These securities are

also generally valued using non-binding quotes from brokers or other indicative pricing sources.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for additional information

regarding FAS 157 Fair Value Measurements. Refer to Part II, Item 8, Note 6 of the Notes to Consolidated

Financial Statements for additional information regarding marketable securities.

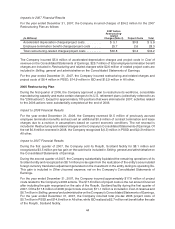

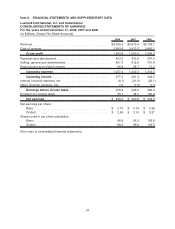

In addition to investing in marketable securities, the Company also invested $217.7 million, $182.7 million

and $200.2 million into property, plant and equipment for the years 2008, 2007 and 2006 respectively.

Further discussion regarding 2008 capital expenditures as well as anticipated spending for 2009 are

provided near the end of Item 7.

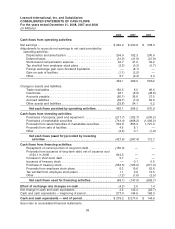

Other notable investing cash flows include $4.6 million proceeds received from the sale of the Company’s

inkjet supplies assembly plant located in Juarez, Mexico in the third quarter of 2008 as well as $8.1 million

proceeds received from the sale of the Scotland facility that occurred in the first quarter of 2007. These

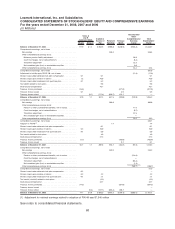

events are presented in Proceeds from sale of facilities in the Investing section of the Consolidated

Statements of Cash Flows for their respective periods.

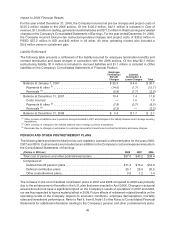

Financing activities

The fluctuations in the net cash flows used for financing activities were principally due to the Company’s

share repurchase activity, offset partially by the repayment of debt and issuance of new debt that occurred

in the second quarter of 2008. The Company repurchased $0.6 billion, $0.2 billion and $0.9 billion of

treasury stock during 2008, 2007 and 2006, respectively. Refer to the sections that follow for additional

information regarding these financing activities.

Share Repurchases

In May 2008, the Company received authorization from the board of directors to repurchase an additional

$750 million of its Class A Common Stock for a total repurchase authority of $4.65 billion. As of

December 31, 2008, there was approximately $0.5 billion of share repurchase authority remaining.

This repurchase authority allows the Company, at management’s discretion, to selectively repurchase

its stock from time to time in the open market or in privately negotiated transactions depending upon

market price and other factors. During 2008, the Company repurchased approximately 17.5 million shares

at a cost of approximately $0.6 billion, including two accelerated share repurchase agreements discussed

below. As of December 31, 2008, since the inception of the program in April 1996, the Company had

repurchased approximately 91.6 million shares for an aggregate cost of approximately $4.2 billion. As of

December 31, 2008, the Company had reissued approximately 0.5 million shares of previously

50