Lexmark 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total interest and other (income) expense, net, was income of $28 million in 2007 compared to income of

$17 million in 2006. During 2007, the Company substantially liquidated the remaining operations of its

Scotland entity and recognized an $8.1 million pre-tax gain from the realization of the entity’s accumulated

foreign currency translation adjustment generated on the investment in the entity during its operating life.

Provision for Income Taxes and Related Matters

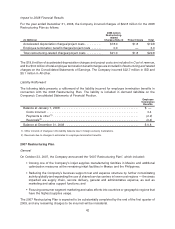

The Company’s effective income tax rate was approximately 12.9%, 13.9%, and 26.3% in 2008, 2007, and

2006, respectively.

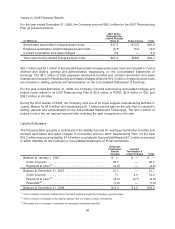

The 1.0 percentage point reduction of the effective tax rate from 2007 to 2008 was due to a reduction of

5.3 percentage points, primarily related to the geographic shift in earnings along with a variety of other

factors, partially offset by a smaller amount of reversals and adjustments to previously accrued taxes in

2008 (increase of 4.3 percentage points). During 2008, the Company reversed $11.6 million of previously

accrued taxes principally due to the settlement of the U.S. tax audit for years 2004 and 2005.

The 12.4 percentage point reduction of the effective tax rate from 2006 to 2007 was primarily due to a

geographic shift of earnings (6.9 percentage points) as well as reversals and adjustments of previously

accrued taxes (5.4 percentage points). During 2007, the Company reversed $18.4 million of previously

accrued taxes mostly due to the settlement of a tax audit outside the U.S. and recorded $11.2 million of

adjustments to previously recorded tax amounts. Specific to the fourth quarter of 2007, the Company

recorded adjustments of $6.4 million to previously recorded tax amounts. The impact of these adjustments

was insignificant to prior periods.

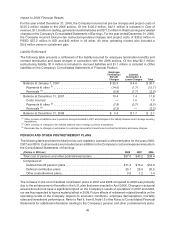

The 2006 effective income tax rate included a $14.3 million benefit from the reversal of previously accrued

taxes related to the finalization of certain tax audits and the expiration of various domestic and foreign

statutes of limitation. During 2006, the Company was subject to a tax holiday in Switzerland with respect to

the earnings of one of the Company’s wholly-owned Swiss subsidiaries. The holiday expired at the end of

2006. The benefit derived from the tax holiday was $1.6 million in 2006.

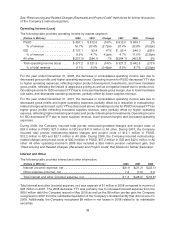

Net Earnings

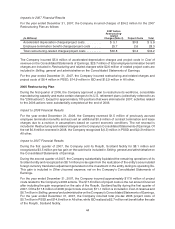

Net earnings for the year ended December 31, 2008 decreased 20% from the prior year primarily due to

lower operating income partially offset by a lower effective tax rate. Net earnings in 2008 included

$92.7 million of pre-tax restructuring-related charges and project costs in connection with the Company’s

restructuring activities. See “Restructuring and Related Charges (Reversals) and Project Costs” that

follows for further discussion. Net earnings in 2008 also included $12 million of non-recurring tax benefits.

Net earnings for the year ended December 31, 2007 decreased 11% from the prior year primarily due to

lower operating income partially offset by a lower effective tax rate. Net earnings in 2007 included

$52.0 million (net of a $3.5 million pre-tax gain on the sale of the Rosyth, Scotland facility) of pre-tax

restructuring-related charges and project costs in connection with the Company’s restructuring activities.

See “Restructuring and Related Charges (Reversals) and Project Costs” that follows for further

discussion. Net earnings in 2007 also included an $8.1 million pre-tax foreign exchange gain realized

upon the substantial liquidation of the Company’s Scotland entity and $29 million of non-recurring tax

benefits.

Net earnings in 2006 included $135.1 million of pre-tax restructuring-related charges and project costs, a

$9.9 million pre-tax pension curtailment gain and a $14.3 million income tax benefit from the reversal of

previously accrued taxes related to the finalization of certain tax matters.

39