Lexmark 2008 Annual Report Download - page 33

Download and view the complete annual report

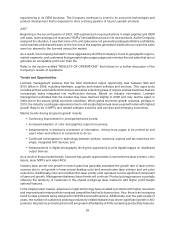

Please find page 33 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recurring supplies sales. Management believes that Lexmark has the following strengths related to this

business model:

• Lexmark is exclusively focused on distributed output and imaging, and related solutions.

• Lexmark internally develops three of the key print technologies associated with distributed printing,

including inkjet, monochrome laser and color laser.

• Lexmark has leveraged its technological capabilities and its commitment to flexibility and

responsiveness to build strong relationships with large-account customers and channel partners.

Lexmark’s strategy involves the following core strategic initiatives:

• Leverage the Company’s unique strengths in PSSD to grow workgroup devices; and

• Shift the ISD strategy to focus on customers, markets and channels that drive higher page

generation and supplies.

Over the last several years, the Company increased investments in both the Company’s sales force and

product and solution development. The Company increased its research and development spending by

5% in 2008, 9% in 2007 and by 10% in 2006. This investment has led to new products and solutions aimed

at targeted growth segments, as well as a pipeline of future products.

The Company’s strategy for dot matrix printers is to continue to offer high-quality products while managing

cost to maximize cash flow and profit.

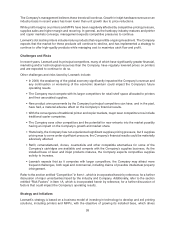

Refer to the section entitled “Strategy” in Item 1, which is incorporated herein by reference, for a further

discussion of the Company’s strategies and initiatives.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Lexmark’s discussion and analysis of its financial condition and results of operations are based upon the

Company’s consolidated financial statements, which have been prepared in accordance with accounting

principles generally accepted in the U.S. The preparation of consolidated financial statements requires

management to make estimates and judgments that affect the reported amounts of assets, liabilities,

revenue and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, the

Company evaluates its estimates, including those related to customer programs and incentives, product

returns, doubtful accounts, inventories, stock-based compensation, income taxes, warranty obligations,

copyright fees, restructurings, pension and other postretirement benefits, and contingencies and litigation.

Lexmark bases its estimates on historical experience and on various other assumptions that are believed

to be reasonable under the circumstances, the results of which form the basis for making judgments about

the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results

may differ from these estimates under different assumptions or conditions.

An accounting policy is deemed to be critical if it requires an accounting estimate to be made based on

assumptions about matters that are uncertain at the time the estimate is made, if different estimates

reasonably could have been used, or if changes in the estimate that are reasonably likely to occur could

materially impact the financial statements. The Company believes the following critical accounting policies

affect its more significant judgments and estimates used in the preparation of its consolidated financial

statements.

Revenue Recognition

Lexmark records estimated reductions to revenue at the time of sale for customer programs and incentive

offerings including special pricing agreements, promotions and other volume-based incentives. Estimated

reductions in revenue are based upon historical trends and other known factors at the time of sale.

Lexmark also records estimated reductions to revenue for price protection, which it provides to

substantially all of its distributor and reseller customers. The amount of price protection is limited

based on the amount of dealers’ and resellers’ inventory on hand (including in-transit inventory) as of

27