Lexmark 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Common Stock. Approximately 47.9 million shares of Class A Common Stock have been authorized for

these stock incentive plans.

For the years ended December 31, 2008, 2007 and 2006, the Company incurred pre-tax stock-based

compensation expense under SFAS 123R of $32.8 million, $41.3 million and $43.2 million, respectively, in

the Consolidated Statements of Earnings.

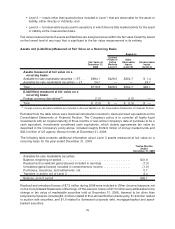

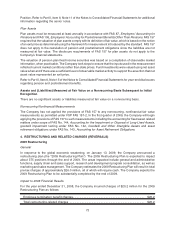

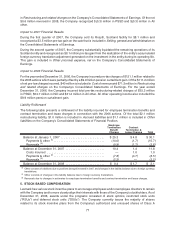

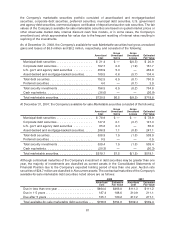

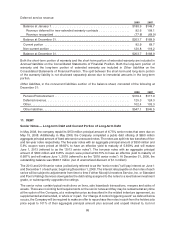

The following table presents a breakout of the stock-based compensation expense recognized for the

years ended December 31:

2008 2007 2006

Cost of revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.8 $ 3.4 $ 6.0

Research and development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.1 6.2 6.9

Selling, general and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.9 31.7 30.3

Stock-based compensation expense before income taxes . . . . . . . . . . . 32.8 41.3 43.2

Income tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12.2) (15.9) (16.5)

Stock-based compensation expense after income taxes . . . . . . . . . . . . . $ 20.6 $ 25.4 $ 26.7

Under the Company’s stock incentive plans, awards granted to certain employees who meet age and/or

service requirements prescribed in the plan will continue to vest after the employees’ retirement with no

additional service requirements. Prior to the adoption of SFAS 123R, the Company recognized cost, on a

pro forma basis, over the stipulated vesting period of these awards. Per SEC guidance, the Company is

continuing to account for these awards in this manner subsequent to the adoption of SFAS 123R. For any

awards granted after the adoption of SFAS 123R to employees who meet the age and/or service

requirements, the Company is recognizing the cost of these awards over the period that the employee

is required to provide service until the employee may retire and continue to vest in these awards. The

change in method of accounting for these awards is not material for any periods presented.

On December 31, 2005, Lexmark accelerated the vesting of certain unvested “out-of-the-money” stock

options with exercise prices equal to or greater than $80.00 per share. These options, which were

previously awarded to its employees under the Company’s equity compensation plans, would have

otherwise vested in the years 2006 through 2008. The vesting was effective for approximately 2.4 million

unvested options, or 39% of the Company’s total outstanding unvested options as of December 31, 2005.

Acceleration of options held by non-employee directors and executive officers were not included in the

vesting acceleration. The acceleration of these options eliminated future compensation expense the

Company would otherwise have recognized in its income statement with respect to these accelerated

options upon the adoption of SFAS 123R. As a result of the acceleration, the Company recognized an

additional $25 million (pre-tax) of stock-based employee compensation expense in the 2005 pro forma

disclosure information provided in the prior year’s 10-K filing.

Stock Options

Generally, options expire ten years from the date of grant. Options granted during 2008, 2007 and 2006,

vest in approximately equal annual installments over a three-year period based upon continued

employment or service on the board of directors.

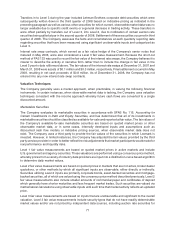

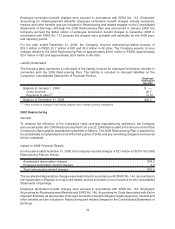

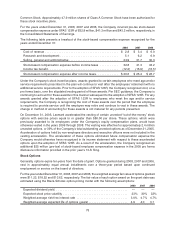

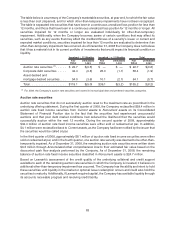

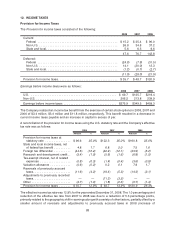

For the year ended December 31, 2008, 2007 and 2006, the weighted average fair value of options granted

were $11.23, $18.52 and $13.62, respectively. The fair value of each option award on the grant date was

estimated using the Black-Scholes option-pricing model with the following assumptions:

2008 2007 2006

Expected dividend yield. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — —

Expected stock price volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33% 30% 32%

Weighted average risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.0% 4.7% 4.7%

Weighted average expected life of options (years) . . . . . . . . . . . . . . . . . . . . . . . 4.9 4.0 3.1

78