Lexmark 2008 Annual Report Download - page 55

Download and view the complete annual report

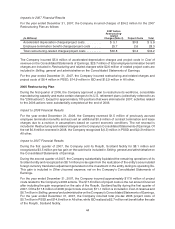

Please find page 55 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2008 there were several significant market events, including the bankruptcy of Lehman Brothers

Holdings and the failure of many auction rate securities. In 2008, Lexmark transferred its Lehman Brothers

corporate debt securities into the Level 3 category of the fair value hierarchy, and subsequently took a

charge of $4.4 million based on the estimated fair value of the investments determined from indicative

pricing sources. Additionally in 2008, the Company recognized a $1.9 million charge for other-than-

temporary impairment in connection with its auction rate fixed income securities; the fair value of which

was determined using an internal discount cash flow valuation model discussed later in this section. The

Company also incurred another $1.0 million of charges related to other-than-temporary impairments of

certain distressed corporate debt, mortgage-backed and asset-backed securities. The $7.3 million in total

losses were recognized in Other (income) expense, net on the Consolidated Statements of Earnings and

included in the Company’s Level 3 rollforward table in Part II, Item 8, Note 3 of the Notes to Consolidated

Financial Statements. In addition, the Company has recognized a cumulative, pre-tax valuation allowance

of $1.7 million included in Accumulated other comprehensive loss on the Consolidated Statements of

Financial Position, representing a temporary impairment of the overall portfolio. The pre-tax valuation

allowance consists of gross unrealized losses of $8.2 million, primarily related to asset-backed and

mortgage-backed securities and corporate debt securities, offset partially by $6.5 million of gross

unrealized holding gains related mostly to US government and agency securities.

The Company assesses its marketable securities for other-than-temporary declines in value by

considering several factors that include, among other things, any events that may affect the

creditworthiness of a security’s issuer, current and expected market conditions, the length of time and

extent to which fair value is less than cost, and the Company’s ability and intent to hold the security until a

forecasted recovery of fair value that may include holding the security to maturity. As of February 27, 2009,

the Company does not believe that it has a material risk in its current portfolio of investments that would

impact its financial condition or liquidity.

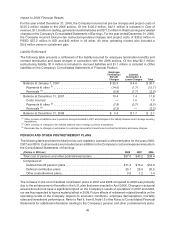

Auction rate securities that do not successfully auction reset to the maximum rate as prescribed in the

underlying offering statement. During the first quarter of 2008, the Company reclassified $59.4 million in

auction rate fixed income securities from Current assets to Noncurrent assets on its Consolidated

Condensed Statement of Financial Position due to the fact that the securities had experienced

unsuccessful auctions and poor debt market conditions had reduced the likelihood that the securities

would successfully auction within the next 12 months. During the next three quarters, $40.5 million of the

Company’s auction rate securities were either sold or redeemed at par, resulting in no realized losses in

2008. At year-end 2008, the Company performed a discounted cash flow analysis on its remaining auction

rate securities that resulted in a mark to market loss adjustment of $2.5 million. Of this $2.5 million loss

adjustment, $1.9 million (mentioned previously) was recognized in the Consolidated Statements of

Earnings as an other than temporary impairment due to credit events involving the issuer and insurer

of one security. The remaining $0.6 million was recognized in Accumulated other comprehensive loss on

the Consolidated Statements of Financial Position. Based on Lexmark’s assessment of the credit quality of

the underlying collateral and credit support available to each of the auction rate securities in which the

Company is invested, it believes no additional other than temporary impairment has occurred. The

Company has the ability and intent to hold these securities until liquidity in the market or optional issuer

redemption occurs and could also hold the securities to maturity. Additionally, if Lexmark required capital,

the Company has available liquidity through its accounts receivable program and revolving credit facility.

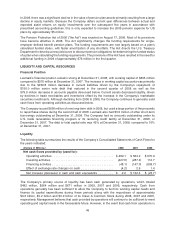

Recent events have led to an increased focus on fair value accounting, including the practices companies

utilize to value financial instruments. The Company uses a third party to provide the fair values of the

marketable securities in which Lexmark is invested, though the valuation of its investments is the

responsibility of the Company. The Company has performed a reasonable level of due diligence in the

way of documenting the pricing methodologies used by the third party as well as a limited amount of

sampling of the valuations. Most of the Company’s securities are valued using a consensus price method,

whereby prices from a variety of industry data providers (multiple quotes) are input into a distribution-curve

based algorithm to determine daily market values. Pricing inputs for a select number of securities were

provided and compared to the overall valuation for reasonableness. In limited instances, the Company has

49