Lexmark 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

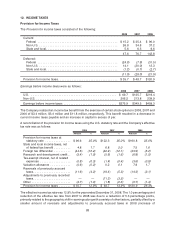

4.3 percentage points). During 2008, the Company reversed $11.6 million of previously accrued taxes

principally due to the settlement of the U.S. tax audit for years 2004 and 2005.

The effective income tax rate was 13.9% for the year ended December 31, 2007. The 12.4 percentage

point reduction YTY of the effective tax rate was primarily due to a geographic shift of earnings

(6.9 percentage points) as well as reversals and adjustments of previously accrued taxes

(5.4 percentage points). During 2007, the Company reversed $18.4 million of previously accrued taxes

principally due to the settlement of a tax audit outside the U.S. and recorded $11.2 million of adjustments to

previously recorded tax amounts. Specific to the fourth quarter of 2007, the Company recorded

adjustments of $6.4 million to previously recorded tax amounts. The impact of these adjustments was

insignificant to prior periods.

The effective income tax rate was 26.3% for the year ended December 31, 2006. During 2006, the IRS

completed its examination of the Company’s income tax returns for the years 2002 and 2003. Upon

completion of that audit, the Company reversed $2.5 million of previously accrued taxes. Additionally, the

Company also reversed $11.8 million of previously accrued taxes based on the expiration of various

domestic and foreign statutes of limitation. The benefit of those two reversals was included in the 2006 tax

rate.

During 2006, the Company was subject to a tax holiday in Switzerland with respect to the earnings of one of

the Company’s wholly-owned Swiss subsidiaries. The holiday expired at the end of 2006. The benefit

derived from the tax holiday was $1.6 million in 2006.

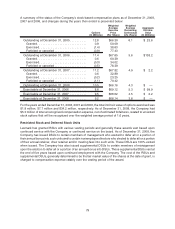

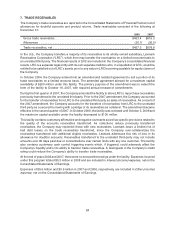

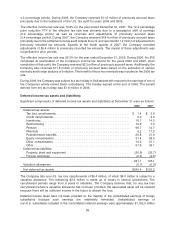

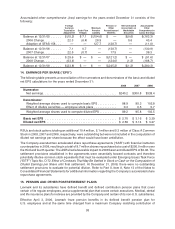

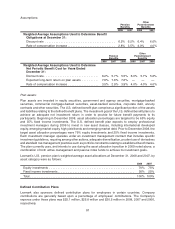

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

2008 2007

Deferred tax assets:

Tax loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.4 $ 2.6

Credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.2 4.3

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.7 14.5

Restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.8 7.5

Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98.7 14.7

Warranty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.2 11.2

Postretirement benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.8 21.9

Equity compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.4 28.5

Other compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.2 21.1

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57.6 34.1

Deferred tax liabilities:

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20.5) (32.7)

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.4) (2.6)

241.1 125.1

Valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.7) (0.9)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $240.4 $124.2

The Company has non-U.S. tax loss carryforwards of $6.4 million, of which $4.0 million is subject to a

valuation allowance. The remaining $2.4 million is made up of losses in several jurisdictions. The

carryforward periods range from 6 years to indefinite. The Company believes that, for any tax loss

carryforward where a valuation allowance has not been provided, the associated asset will be realized

because there will be sufficient income in the future to absorb the loss.

Deferred income taxes have not been provided on the majority of the undistributed earnings of foreign

subsidiaries because such earnings are indefinitely reinvested. Undistributed earnings of

non-U.S. subsidiaries included in the consolidated retained earnings were approximately $1,152.3 million

89