Lexmark 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Lexmark’s Class A Common Stock is traded on the New York Stock Exchange under the symbol LXK. As of

February 20, 2009, there were 3,035 holders of record of the Class A Common Stock and there were no

holders of record of the Class B Common Stock. Information regarding the market prices of the Company’s

Class A Common Stock appears in Part II, Item 8, Note 19 of the Notes to Consolidated Financial

Statements.

Dividend Policy

The Company has never declared or paid any cash dividends on the Class A Common Stock and has no

current plans to pay cash dividends on the Class A Common Stock. The payment of any future cash

dividends will be determined by the Company’s board of directors in light of conditions then existing,

including the Company’s earnings, financial condition and capital requirements, restrictions in financing

agreements, business conditions, tax laws, certain corporate law requirements and various other factors.

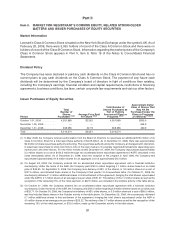

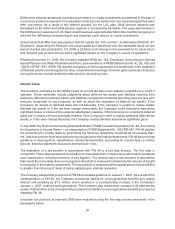

Issuer Purchases of Equity Securities

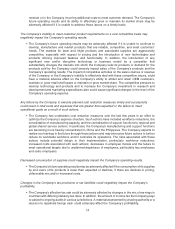

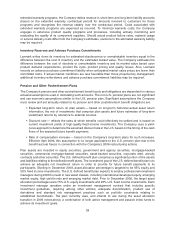

Period

Total

Number of

Shares

Purchased

(2)(3)

Average Price Paid

Per Share

(2)(3)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

(2)(3)

Approximate Dollar

Value of Shares That

May Yet Be

Purchased Under the

Plans or Programs

(In Millions)

(1)(2)(3)

October 1-31, 2008 . . . . . . . . . 4,551,989 $23.62 4,551,989 $505.9

November 1-30, 2008 . . . . . . . . — — — 505.9

December 1-31, 2008 . . . . . . . . 658,585 22.78 658,585 490.9

Total . . . . . . . . . . . . . . . . . . . 5,210,574 $23.51 5,210,574

(1) In May 2008, the Company received authorization from the Board of Directors to repurchase an additional $750 million of its

Class A Common Stock for a total repurchase authority of $4.65 billion. As of December 31, 2008, there was approximately

$0.5 billion of share repurchase authority remaining. This repurchase authority allows the Company, at management’s discretion,

to selectively repurchase its stock from time to time in the open market or in privately negotiated transactions depending upon

market price and other factors. For the three months ended December 31, 2008, the Company repurchased approximately

5.2 million shares at a cost of $122.5 million through two accelerated share repurchase agreements (“ASR”) described in the

notes immediately below. As of December 31, 2008, since the inception of the program in April 1996, the Company had

repurchased approximately 91.6 million shares for an aggregate cost of approximately $4.2 billion.

(2) On August 28, 2008, the Company entered into an accelerated share repurchase agreement with a financial institution

counterparty. Under the terms of the ASR, the Company paid $150.0 million targeting 4.1 million shares based on an initial

price of $36.90. On September 3, 2008, the Company took delivery of 85% of the shares, or 3.5 million shares at a cost of

$127.5 million, and included these shares in the Company’s third quarter 10-Q repurchase table. On October 21, 2008, the

counterparty delivered 1.2 million additional shares in final settlement of the agreement, bringing the total shares repurchased

under the ASR to 4.7 million shares at an average price per share of $31.91. The delivery of the 1.2 million shares as well as the

recognition of the remaining 15% of the initial payment, or $22.5 million, are included in the October activity in the table above.

(3) On October 21, 2008, the Company entered into an accelerated share repurchase agreement with a financial institution

counterparty. Under the terms of the ASR, the Company paid $100.0 million targeting 3.9 million shares based on an initial price

of $25.71. On October 24, 2008, the Company took delivery of 85% of the shares, or 3.3 million shares at a cost of $85.0 million,

and has included these shares in the October activity in the table above. On December 26, 2008, the counterparty delivered

0.7 million additional shares in final settlement of the agreement, bringing the total shares repurchased under the ASR to

4.0 million shares at an average price per share of $25.22. The delivery of the 0.7 million shares as well as the recognition of the

remaining 15% of the initial payment, or $15.0 million, make up the December activity in the table above.

20