Lexmark 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.community’s concerns about how to conduct fair value accounting in a time of significant market distress.

The Company has considered the additional guidance with respect to the valuation of its marketable

securities portfolio and the designation of its investments within the fair value hierarchy in the Company’s

2008 financial statements and footnotes.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for additional details

regarding FAS 157, FSP FAS 157-2 and FSP FAS 157-3.

The Company utilizes observable market data, when available, to determine fair value. However, in certain

situations, there may be little or no market data available at the measurement date thus requiring the use of

significant unobservable inputs. To the extent that a valuation is based on models, inputs or assumptions

that are less observable in the market, the determination of fair value requires more judgment. Such

measurements are generally classified as Level 3 within the fair value hierarchy.

Recent uncertainty in the capital markets has presented additional challenges with respect to valuing

marketable securities and pension plan assets in which the Company is invested. Because of the general

decline in trading activity for some investments, the Company has undertaken additional steps in its closing

process during the third and fourth quarters of 2008 to assess whether or not the pricing information it

received was reasonably up to date as well as to understand the nature of quotes used in the valuation of

certain securities. In the case of auction rate securities in which auctions were unsuccessful, observable

pricing data was not available resulting in the Company performing its own discounted cash flow analysis

based on assumptions that it believes market participants would use with regard to such items as expected

cash flows and discount rates adjusted for illiquidity premiums. In determining where measurements lie in

the fair value hierarchy, the Company uses assumptions regarding the general characteristics of each type

of security as the starting point. The Company then downgrades individual securities to a lower level as

necessary based on specific facts and circumstances.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for the Company’s

disclosures regarding fair value. Also, refer to the Liquidity and Capital Resources section of Item 7 for

additional information regarding the Company’s significant Level 3 valuations.

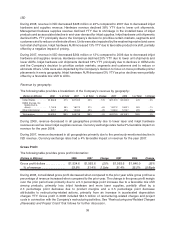

RESULTS OF OPERATIONS

Operations Overview

Key Messages

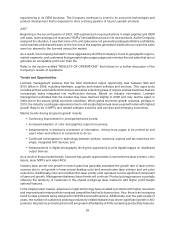

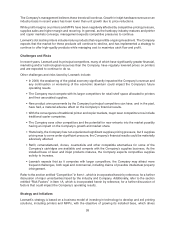

Lexmark is focused on driving long-term performance by strategically investing in technology and demand

generation to enable the Company to profitably capture supplies in high page-growth segments of the

distributed printing market.

• The PSSD strategy is focused on growth in high page generating workgroup products, including

monochrome lasers, color laser printers and laser MFPs. During 2008, the Company experienced

double-digit percentage unit growth in its branded laser MFP units and also had growth in laser supplies.

• The Company continues to aggressively shift its focus in ISD to geographic regions, product

segments, and customers that generate higher page usage. This strategy shift continues to

increase the Company’s focus on higher priced, higher usage devices, customers and

countries. The Company’s initiative in wireless inkjets is a part of the strategic shift and the

Company believes it has captured some significant market share related to these products in its

top six countries.

Lexmark continues to take actions to improve its cost and expense structure including continuing to

implement restructuring activities of its business to lower its cost and better allow it to fund these strategic

initiatives.

32