Lexmark 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Position. Refer to Part II, Item 8, Note 11 of the Notes to Consolidated Financial Statements for additional

information regarding the senior notes.

Plan Assets

Plan assets must be measured at least annually in accordance with FAS 87, Employers’ Accounting for

Pensions and FAS 106, Employers’ Accounting for Postretirement Benefits Other Than Pensions. FAS 157

requires that the valuation of plan assets comply with its definition of fair value, which is based on the notion

of an exit price as determined using the framework for measurement introduced by the standard. FAS 157

does not apply to the calculation of pension and postretirement obligations since the liabilities are not

measured at fair value. The disclosure requirements of FAS 157 for plan assets do not apply to the

Company’s financial statements.

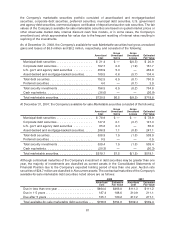

The valuation of pension plan fixed income securities was based on a compilation of observable market

information, when practicable. The Company took steps to ensure that the inputs used in the measurement

reflected current market conditions rather than stale prices. Fund investments were valued using net asset

value when and if there was a sufficient level of observable market activity to support the assertion that net

asset value represented an exit price.

Refer to Part II, Item 8, Note 15 of the Notes to Consolidated Financial Statements for year-end disclosures

regarding pension and postretirement benefits.

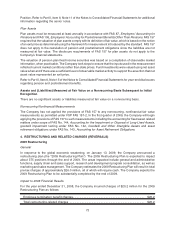

Assets and (Liabilities) Measured at Fair Value on a Nonrecurring Basis Subsequent to Initial

Recognition

There are no significant assets or liabilities measured at fair value on a nonrecurring basis.

Nonrecurring Nonfinancial Measurements

The Company has not applied the provisions of FAS 157 to any nonrecurring, nonfinancial fair value

measurements as permitted under FSP FAS 157-2. In the first quarter of 2009, the Company will begin

applying the provisions of FAS 157 to such measurements including the accounting for fixed asset related

matters under scope of FAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets,

goodwill impairment testing under FAS No. 142, Goodwill and Other Intangible Assets and asset

retirement obligations under FAS No. 143, Accounting for Asset Retirement Obligations.

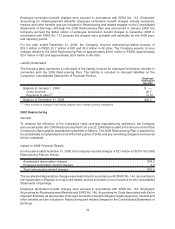

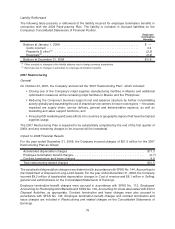

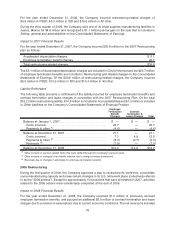

4. RESTRUCTURING AND RELATED CHARGES (REVERSALS)

2009 Restructuring

General

In response to the global economic weakening, on January 13, 2009, the Company announced a

restructuring plan (the “2009 Restructuring Plan”). The 2009 Restructuring Plan is expected to impact

about 375 positions through the end of 2009. The areas impacted include general and administrative

functions, supply chain and sales support, research and development program consolidation, as well as

marketing and sales management. The Company estimates the 2009 Restructuring Plan will result in total

pre-tax charges of approximately $26.0 million, all of which will require cash. The Company expects the

2009 Restructuring Plan to be substantially completed by the end of 2009.

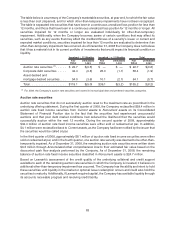

Impact to 2008 Financial Results

For the year ended December 31, 2008, the Company incurred charges of $20.2 million for the 2009

Restructuring Plan as follows:

Employee termination benefit charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $20.2

Total restructuring-related charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $20.2

73