Lexmark 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

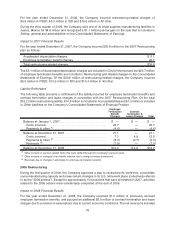

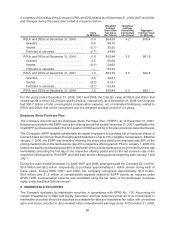

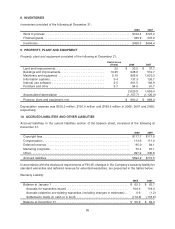

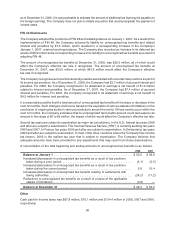

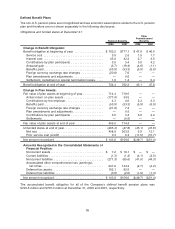

Deferred service revenue:

2008 2007

Balance at January 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $188.9 $149.7

Revenue deferred for new extended warranty contracts . . . . . . . . . . . . . . . . . . 92.6 109.1

Revenue recognized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (77.8) (69.9)

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $203.7 $188.9

Current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82.9 69.7

Non-current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120.8 119.2

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $203.7 $188.9

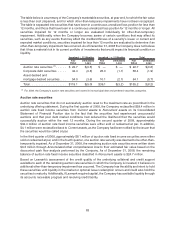

Both the short-term portion of warranty and the short-term portion of extended warranty are included in

Accrued liabilities on the Consolidated Statements of Financial Position. Both the long-term portion of

warranty and the long-term portion of extended warranty are included in Other liabilities on the

Consolidated Statements of Financial Position. The split between the short-term and long-term portion

of the warranty liability is not disclosed separately above due to immaterial amounts in the long-term

portion.

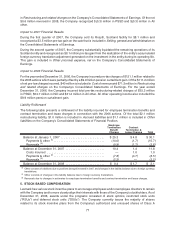

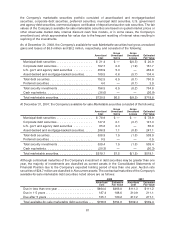

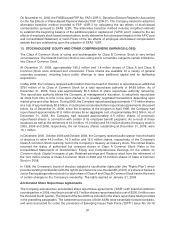

Other liabilities, in the noncurrent liabilities section of the balance sheet, consisted of the following at

December 31:

2008 2007

Pension/Postretirement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $319.4 $117.9

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125.3 124.3

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102.4 103.3

Other liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $547.1 $345.5

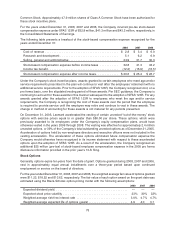

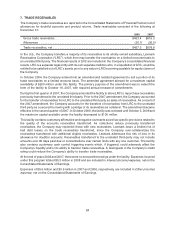

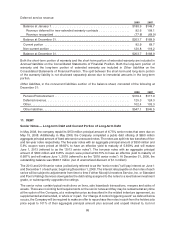

11. DEBT

Senior Notes — Long-term Debt and Current Portion of Long-term Debt

In May 2008, the company repaid its $150 million principal amount of 6.75% senior notes that were due on

May 15, 2008. Additionally, in May 2008, the Company completed a public debt offering of $650 million

aggregate principal amount of fixed rate senior unsecured notes. The notes are split into two tranches of five-

and ten-year notes respectively. The five-year notes with an aggregate principal amount of $350 million and

5.9% coupon were priced at 99.83% to have an effective yield to maturity of 5.939% and will mature

June 1, 2013 (referred to as the “2013 senior notes”). The ten-year notes with an aggregate principal

amount of $300 million and 6.65% coupon were priced at 99.73% to have an effective yield to maturity of

6.687% and will mature June 1, 2018 (referred to as the “2018 senior notes”). At December 31, 2008, the

outstanding balance was $648.7 million (net of unamortized discount of $1.3 million).

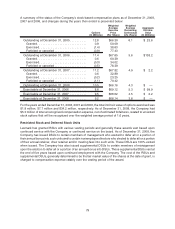

The 2013 and 2018 senior notes (collectively referred to as the “senior notes”) will pay interest on June 1

and December 1 of each year, beginning December 1, 2008. The interest rate payable on the notes of each

series will be subject to adjustments from time to time if either Moody’s Investors Service, Inc. or Standard

and Poor’s Ratings Services downgrades the debt rating assigned to the notes to a level below investment

grade, or subsequently upgrades the ratings.

The senior notes contain typical restrictions on liens, sale leaseback transactions, mergers and sales of

assets. There are no sinking fund requirements on the senior notes and they may be redeemed at any time

at the option of the Company, at a redemption price as described in the related indenture agreement, as

supplemented and amended, in whole or in part. If a “change of control triggering event” as defined below

occurs, the Company will be required to make an offer to repurchase the notes in cash from the holders at a

price equal to 101% of their aggregate principal amount plus accrued and unpaid interest to, but not

86