Lexmark 2008 Annual Report Download - page 74

Download and view the complete annual report

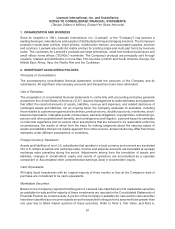

Please find page 74 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company is in the process of evaluating the inputs and techniques used in its nonrecurring, nonfinancial

fair value measurements.

In October 2008, the FASB issued FASB Staff Position (“FSP”) No. FAS 157-3 (“FSP FAS 157-3”)

Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active in response

to the financial community’s concerns about how to conduct fair value accounting in a time of significant

market distress. The new FSP confirms that the objective of FAS 157 is still the price that would be received

by the holder of the asset in an orderly transaction that is not a forced liquidation or distressed sale, even in

situations in which there is little, if any, market activity. The FSP also states acceptance of the use of

management’s internal assumptions about future cash flows and appropriately risk-adjusted discount

rates when observable inputs are not available, and that in some cases, observable inputs may need

significant adjustment based on unobservable data to better reflect the risk adjustments that market

participants would make for nonperformance and liquidity risks. Lastly, FSP 157-3 offers additional

guidance on the appropriate use of broker quotes, indicating that they are not necessarily

determinative of fair value if an active market does not exist for the financial asset, and that the nature

of the quote, either a binding offer or an indicative price, should be considered when weighing the

appropriate inputs to use in measuring fair value. The FSP became immediately effective upon issuance,

including prior periods for which financial statements have not been issued. Revisions resulting from a

change in the valuation technique or its application shall be accounted for as a change in accounting

estimate. The Company has considered the additional guidance with respect to the valuation of its

marketable securities portfolio and the designation of its investments within the fair value hierarchy in the

Company’s 2008 financial statements and footnotes.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Liabilities (“FAS 159”). FAS 159 provides entities with the option to report selected financial assets and

liabilities at fair value. Business entities adopting FAS 159 will report unrealized gains and losses in

earnings at each subsequent reporting date on items for which the fair value option has been elected. The

Company has not elected the fair value option for any of its assets or liabilities.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging

Activities — an amendment of FASB Statement No. 133 (“FAS 161”). FAS 161 changes the disclosure

requirements for derivative instruments and hedging activities. Entities are required to provide enhanced

disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments

and related hedged items are accounted for under Statement 133 and its related interpretations, and

(c) how derivative instruments and related hedged items affect an entity’s financial position, financial

performance, and cash flows. FAS 161 is effective for financial statements issued for fiscal years and

interim periods beginning after November 15, 2008, with early application encouraged. FAS 161

encourages, but does not require, comparative disclosures for earlier periods at initial adoption. The

Company is currently evaluating the provisions of FAS 161.

In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles

(“FAS 162”). FAS 162 identifies the sources of accounting principles and the framework for selecting

principles to be used in the preparation of financial statements that are presented in conformity with United

States GAAP. The GAAP hierarchy was previously set forth in the American Institute of Certified Public

Accountants (“AICPA”) Statement on Auditing Standards No. 69, The Meaning of Present Fairly in

Conformity With Generally Accepted Accounting Principles. Though the FASB does not expect a

change in current practice, the Board issued this statement in order for the U.S. GAAP hierarchy to

reside in the accounting literature established by the FASB. FAS 162 is effective 60 days following the

SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, The

Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles. Any effect of

applying the provisions of FAS 162 shall be reported as a change in accounting principle in accordance

with SFAS No. 154, Accounting Changes and Error Corrections. The Company does not expect FAS 162 to

have a material impact on its financial statements.

68