Lexmark 2008 Annual Report Download - page 78

Download and view the complete annual report

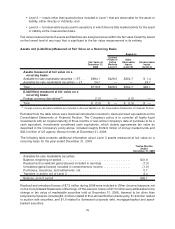

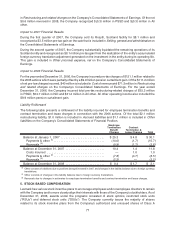

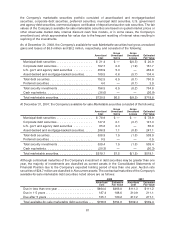

Please find page 78 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which recent auctions were unsuccessful, valued at $24.7 million, certain distressed debt instruments

valued at $0.8 million and other thinly traded corporate debt securities and mortgage-backed securities

valued at $0.6 million.

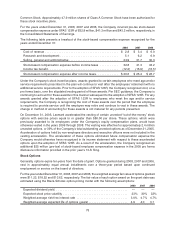

The Company performed a discounted cash flow analysis on its auction rate securities at year-end 2008,

using current coupon rates, a first quarter 2010 redemption date and a 50 basis point liquidity premium

factored into the discount rate. The result was a downward YTD mark to market adjustment of $2.5 million

representing the Company’s best estimate of fair value using assumptions that the Company believes

market participants would make for nonperformance and liquidity risk at the measurement date. Of the

$2.5 million, $1.9 million was recognized in the Consolidated Statements of Earnings as other than

temporarily impaired due to credit events involving the issuer and insurer of one security. The remaining

$0.6 million was recognized in Accumulated other comprehensive loss on the Consolidated Statements of

Financial Position representing the mark to market adjustment on all other auction rate securities. All other

auction rate securities held by the Company are highly rated and the Company believes it has sufficient

liquidity to hold these securities until sold or repurchased at par. The issuers of these securities have the

legal option to redeem the securities at par plus accrued interest at each auction rate reset date and the

securities are being made available for sale at par at auctions every 35 to 49 days. All of the auction rate

securities held by the Company at December 31, 2008 are currently paying penalty rates that provide a

premium over market interest rates to compensate investors for the failed auctions and provide an

incentive for issuers to refinance these securities in the capital markets prior to maturity. Since

reclassifying to noncurrent assets the securities that did not auction successfully at the end of the first

quarter 2008, $40.5 million of auction rate fixed income securities have been either sold or redeemed at

par. There were no realized losses in 2008 from the sale or redemption of auction rate securities.

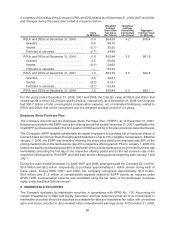

The Company holds certain debt instruments that it considers distressed due to reasons such as

bankruptcy or a significant downgrade in credit rating. These securities are generally valued using

non-binding quotes from brokers or other indicative pricing sources.

For certain corporate debt and mortgage-backed securities held by the Company, current pricing data was

no longer available at the measurement date, representing a decline in the volume and level of trading

activity. These securities are also generally valued using non-binding quotes from brokers or other

indicative pricing sources.

Derivatives

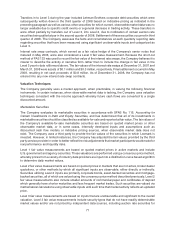

The Company employs a foreign currency risk management strategy that periodically utilizes derivative

instruments to protect its interests from unanticipated fluctuations in earnings and cash flows caused by

volatility in currency exchange rates. Fair values for the Company’s derivative financial instruments are

based on pricing models or formulas using current market data. Variables used in the calculations include

forward points and spot rates at the time of valuation. Because of the very short duration of the Company’s

transactional hedges (three months or less) and minimal risk of nonperformance, the settlement price and

exit price should approximate one another. At December 31, 2008, all of the Company’s forward exchange

contracts have been designated as Level 2 measurements in the FAS 157 fair value hierarchy.

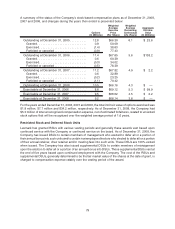

Senior Notes

In the second quarter of 2008, the Company repaid its $150 million of senior note debt that matured on

May 15, 2008, and subsequently issued $350 million of five-year fixed rate senior unsecured notes as well

as $300 million of ten-year fixed rate senior unsecured notes. At December 31, 2008, the fair values of the

Company’s five-year and ten-year notes were estimated to be $280.0 million and $225.0 million,

respectively, based on current rates available to the Company for debt with similar characteristics. The

$505.0 million total fair value of the debt is not recorded on the Company’s Consolidated Statements of

Financial Position and is therefore excluded from the fair value table above. The total carrying value of the

senior notes, net of $1.3 million discount, is $648.7 million on the Consolidated Statements of Financial

72