Lexmark 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

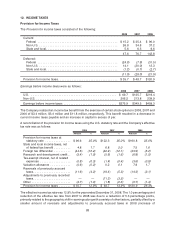

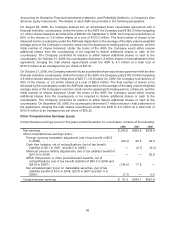

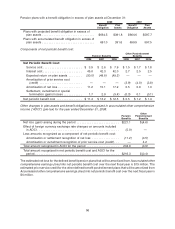

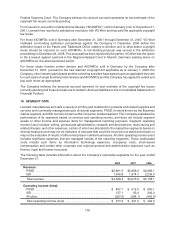

Assumptions:

2008 2007 2008 2007

Pension

Benefits

Other

Postretirement

Benefits

Weighted-Average Assumptions Used to Determine Benefit

Obligations at December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.2% 6.2% 6.4% 6.0%

Rate of compensation increase . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.8% 3.5% 4.0% 4.0%

2008 2007 2006 2008 2007 2006

Pension

Benefits

Other

Postretirement

Benefits

Weighted-Average Assumptions Used to Determine

Net Periodic Benefit Cost for Years Ended

December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.2% 5.7% 5.5% 6.0% 5.7% 5.6%

Expected long-term return on plan assets . . . . . . . . . . 7.6% 7.6% 7.6% — — —

Rate of compensation increase . . . . . . . . . . . . . . . . . . 3.5% 2.9% 3.9% 4.0% 4.0% 4.0%

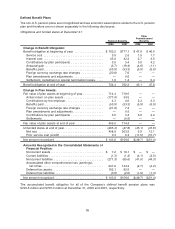

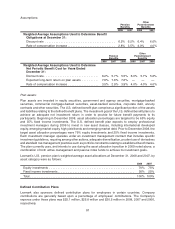

Plan assets:

Plan assets are invested in equity securities, government and agency securities, mortgage-backed

securities, commercial mortgage-backed securities, asset-backed securities, corporate debt, annuity

contracts and other securities. The U.S. defined benefit plan comprises a significant portion of the assets

and liabilities relating to the defined benefit plans. The investment goal of the U.S. defined benefit plan is to

achieve an adequate net investment return in order to provide for future benefit payments to its

participants. Beginning in December 2008, asset allocation percentages are targeted to be 65% equity

and 35% fixed income investments. The U.S. defined benefit plan expects to employ professional

investment managers during 2009 to invest in new asset classes, including international developed

equity, emerging market equity, high yield bonds and emerging market debt. Prior to December 2008, the

target asset allocation percentages were 75% equity investments and 25% fixed income investments.

Each investment manager operates under an investment management contract that includes specific

investment guidelines, requiring among other actions, adequate diversification, prudent use of derivatives

and standard risk management practices such as portfolio constraints relating to established benchmarks.

The plan currently uses, and intends to use during the asset allocation transition in 2009 noted above, a

combination of both active management and passive index funds to achieve its investment goals.

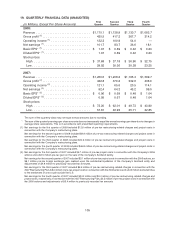

Lexmark’s U.S. pension plan’s weighted-average asset allocations at December 31, 2008 and 2007, by

asset category were as follows:

2008 2007

Equity investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70% 75%

Fixed income investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30% 25%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100% 100%

Defined Contribution Plans

Lexmark also sponsors defined contribution plans for employees in certain countries. Company

contributions are generally based upon a percentage of employees’ contributions. The Company’s

expense under these plans was $25.1 million, $25.8 million and $20.5 million in 2008, 2007 and 2006,

respectively.

97