LensCrafters 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 34 | ANNUAL REPORT 2007

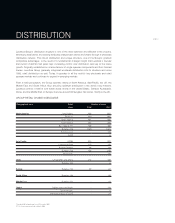

In Asia-Pacific, the Group continued to strengthen its retail operations and consolidate its

leadership in the region. Luxottica worked on the integration of its direct distribution network in

Australia and New Zealand, which now operates three brands in the prescription segment: OPSM,

Laubman & Pank and Budget Eyewear. At the end of 2007, Luxottica’s retail network in the region

numbered 910 stores (551 for the prescription business and 359 for the sun segment).

In China and Hong Kong, Luxottica Group’s organization is already well structured and fully

operational. The next steps will be to boost the visibility of the distribution network and product

brands, thus consolidating the Group’s presence in the country, which is of long-term strategic

importance. The product offering will gradually be tailored to the evolution of the Chinese middle

classes, who tend to favor well established fashion brands.

PRESCRIPTION

LensCrafters

Twelve years after joining Luxottica Group, LensCrafters now spans two continents with significant

presence in the United States, Canada, China and HongKong. It is North America’s leading

operator in the fashion eyewear segment, with 951 stores in the United States and Canada, and by

the end of 2007, 140 stores were operating under the LensCrafters brand in China and Hong Kong.

North America

In 2007, despite the slowdown in the economy in North America and a perceptible shift in the role

of managed vision care affecting consumer choices in the North American optical category, the

total comparable store sales increased for the year. 2007 was a very positive year due in part to

heavy investments enabling LensCrafters to capitalize on favorable trends in the North American

market but also on its internal potential, on which future development will focus.

LensCrafters continued in 2007 to roll out the new fashion store design that debuted in 2006. At the

year end, there were 140 LensCrafters stores featuring the sleek and inviting new look. Comparable

store sales in locations with the new design continue to outpace the rest of the chain by 3% in their

first year after re-model. The new format, characterized by refined, exclusive looking interiors and a

high degree of product personalization, openly addresses customers with sophisticated tastes who

are very demanding in terms of quality of service (a clientele that is becoming increasingly important

as a result of LensCrafters advertising campaigns targeting the American consumer). For example,

the new store concept was forcefully backed by the “Make an Appearance” campaign.

Very positive performance was also recorded by stores that hadn’t undergone restyling but

continued to benefit from development initiatives undertaken in the past.

While the new store design and positioning make LensCrafters the destination for top eyewear

collections from designers such as Burberry, Dolce & Gabbana, Polo Ralph Lauren, Prada, and

Versace. LensCrafters also broadened its selection of conservative and classic frames and Oakley

products to meet male customer demand.

Sales of prescription frames and sunglasses produced by Luxottica Group, particularly its fashion

and luxury brands, accounted for around 57% of total LensCrafters sales in 2007, up 9% over the

prior year. In 2008, LensCrafters looks forward to introducing customers tth important new brand

Tiffany & Co., and a full line of Oakley prescription and sun products.

Lenses are another important dimension of LensCrafters offering and expertise. Sales of Anti-

Reflective lenses continued to grow at 13% in 2007, fueled by an 18% increase in sales of

LensCrafters premium AR lenses and FeatherWates Complete? lenses made with Scotchgard?