LensCrafters 2007 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 160 | ANNUAL REPORT 2007

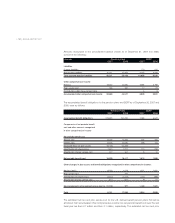

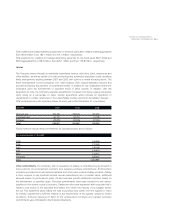

The weighted-average fair value of grant-date fair value options granted during the year 2006 was

Euro 5.13. There were no performance grants issued in 2005 or 2007.

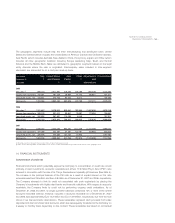

The fair value of the stock options granted was estimated at the date of grant using a binomial lattice

model. The following table presents the weighted - average assumptions used in the valuation and

the resulting weighted average fair value per option granted:

As of December 31, 2007 there was Euro 27.1 million of total unrecognized compensation cost

related to non-vested share-based compensation arrangements; that cost is expected to be

recognized over a period of 0.7 years.

Cash received from option exercises under all share-based arrangements and actual tax benefits

realized for the tax deductions from option exercises are disclosed in the consolidated statements

of shareholders’ Equity.

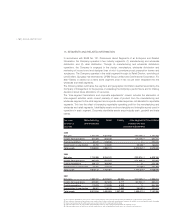

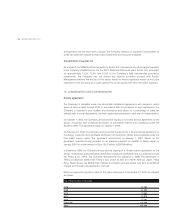

Adoption of SFAS 123 (R). Effective January 1, 2006 the Company adopted the provisions of SFAS

No. 123(R), Share-Based Payment (“SFAS 123(R)”) which requires the Company to measure and

record compensation expense for stock options and other share-based payments based on the fair

value of the instruments. The adoption was made utilizing the modified prospective application

method as defined in SFAS 123(R) and as such applies to awards modified, repurchased or

cancelled after such date and to any portion of awards for which the requisite service has not been

rendered and to every new granted award issued after December 31, 2005. The following table

illustrates the effect on net income and earnings per share had the compensation costs of the plans

been determined under a fair-value based method as stated in SFAS 123 for 2005. The estimated

fair value for each option was calculated using a binomial model:

2007 2006 2005

Plan I Plan II

(a) (b)

Dividend yield - 1.33% 1.33% -

Risk-free interest rate - 3.88% 3.89% -

Expected option life (years) - 5.36 5.53 -

Expected volatility - 26.63% 26.63% -

Weighted average fair value (Euro) - 6.15 5.8 -

(a) Stock Performance Plan issued in July 2006 for a total of 9,500,000 options granted

(b) Stock Performance Plan issued in July 2006 for a total of 3,500,000 options granted