LensCrafters 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 32 | ANNUAL REPORT 2007

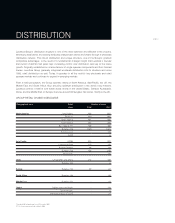

The Group’s wholesale distribution network covers more than 130 countries, with directly

controlled operations in its key 44 markets, where clients are mostly retailers of mid- to premium-

price eyewear, such as independent opticians, optical retail brands, specialty sun retailers and

duty-free shops. In North America and other areas, key clients also include independent

optometrists and ophthalmologists and premium department stores. Direct distribution in the key

markets gives Luxottica Group a considerable competitive edge, making it possible to maintain

close contact with clients, maximize the image and visibility of the Group’s brands and optimize

distribution.

In addition to making some of the best brands, with a broad array of models tailored to the needs

of each market, Luxottica also provides its wholesale clients with the assistance and services

needed to enable their business to be successful.

One of Luxottica Group’s main strengths is its ability to offer pre- and post-sale services which

have been developed and continuously improved over decades. These high-quality services are

designed to provide customers with the best product and in a timeframe and manner that most

enhance their value. The distribution system is connected at the international level to a central

production planning function through a network linking logistics and sales functions and outlets to

the manufacturing plants in Italy and China. Through this network, global sales and inventory are

monitored daily and, based on the information from the market, production resources and

inventory levels are adjusted. This integrated logistics system is one of the most efficient and

fastest in the industry. In Asia, Europe and the United States, centralized distribution centers have

over the years significantly improved distribution speed and efficiency. Luxottica Group is thus able

to provide its clients with a highly automated system for order management that reduces delivery

times and minimizes inventory, while providing high-quality products.

RETAIL

Luxottica Group’s retail division includes:

• Ilori, LensCrafters, Pearle Vision (owned and franchise stores), Sears Optical, Target Optical,

Sunglass Icon, Oakley Stores and Vaults, The Optical Shop of Aspen and Oliver Peoples shops

in North America, where the Group is a leading retailer in optical products;

• OPSM, Laubman & Pank, Bright Eyes and Budget Eyewear stores in Australia and New Zealand,

guaranteeing the Group’s leadership in this region with 910 stores;

• Sunglass Hut, the world’s leading and widest reaching specialty premium sun retail chain, has

2,000 stores mostly in North America, Asia-Pacific, the Middle East and the UK; and

• a network of approximately 250 stores in China and Hong Kong.

In 2007, the retail division, excluding Oakley, saw a slight (1.8%) contraction in its revenues to Euro 3.2

million, mainly due to the unfavorable trend in the Euro/Dollar exchange rate. On a comparable

exchange rate basis, revenues would have grown 5.6%. Further, on a comparable number of stores,

exchange rate and consolidation area basis, and including Oakley, sales increased by 1.2% despite

the ups and downs in the North American market. In Australia and China, two major markets for the

Group, sales were stable. Sunglass Hut continued to develop in all the countries in which it operates:

over the last three years it has recorded 40% growth on comparable stores, exchange rates and

consolidation area basis.

Operating income in the retail business (excluding Oakley) amounted to Euro 362 million, down

16.2% from the previous year, while its ratio to sales (operating margin) was 11.2%.

In 2007, the Group’s retail business benefited from its major investment plan, mainly focused on