LensCrafters 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 142 | ANNUAL REPORT 2007

Certain intangible assets are maintained in currencies other than Euro (the reporting currency) and,

as such, balances may fluctuate due to changes in exchange rates.

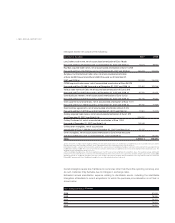

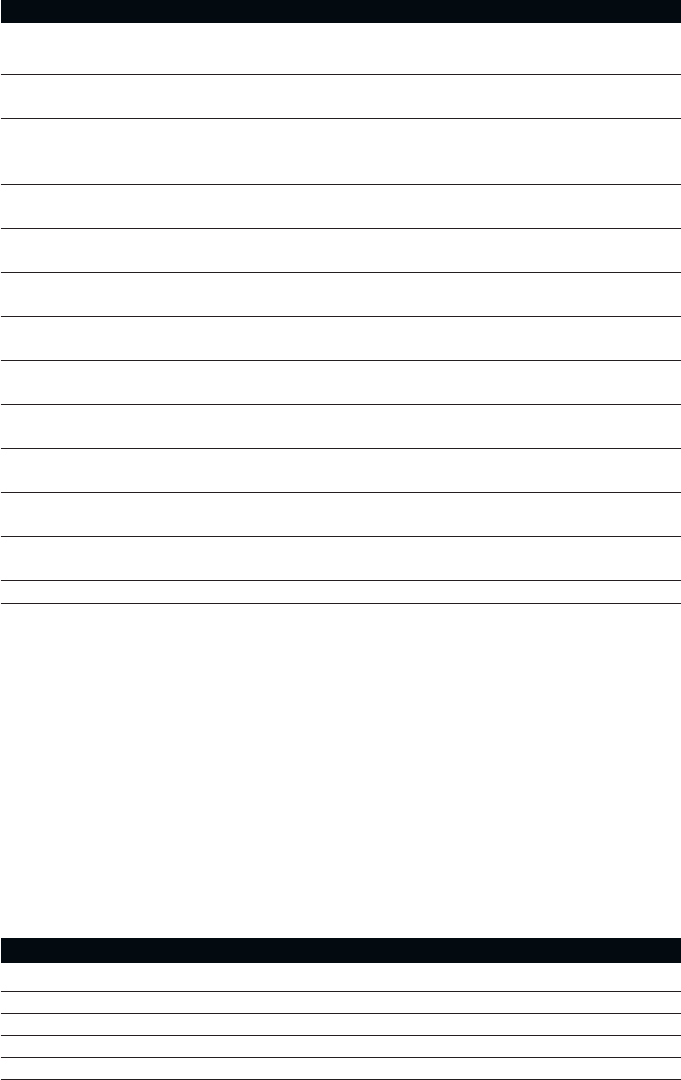

Estimated annual amortization expense relating to identifiable assets, including the identifiable

intangibles attributable to recent acquisitions for which the purchase price allocation is not final, is

shown below:

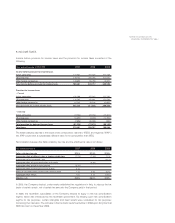

December 31 (Euro/000) 2007 2006

LensCrafters trade name, net of accumulated amortization of Euro 76,080

thousand and Euro 77,518 thousand as of December 31, 2007 and 2006 (a) 74,574 89,187

Ray-Ban acquired trade names, net of accumulated amortization of Euro 118,749

thousand and Euro 104,776 thousand as of December 31, 2007 and 2006 (a) 160,747 174,424

Sunglass Hut International trade name, net of accumulated amortization

of Euro 55,838 thousand and Euro 52,633 thousand as of December 31,

2007 and 2006 (a) 150,969 176,207

OPSM acquired trade names, net of accumulated amortization of Euro 34,576

thousand and Euro 24,466 thousand as of December 31, 2007 and 2006 (a) 112,467 123,158

Various trade names of Cole, net of accumulated amortization of Euro 5,313

thousand and Euro 8,617 thousand as of December 31, 2007 and 2006 (a) 35,550 41,151

Cole distributor network, net of accumulated amortization of Euro 12,120

thousand and Euro 5,500 thousand as of December 31, 2007 and 2006 (b) 66,716 79,054

Cole customer list and contracts, net of accumulated amortization of Euro 7,011

thousand and Euro 4,163 thousand as of December 31, 2007 and 2006 (b) 39,066 45,969

Cole franchise agreements, net of accumulated amortization of Euro 2,515

thousand and Euro 1,927 thousand of December 31, 2007 and 2006 (b) 12,961 15,199

Oakley acquired trade names, net of accumulated amortization of Euro 1,972

as of December 31 2007 (see Note 5) (a) 376,937

Oakley Customer list, net of accumulated amortization of Euro 1,016

thousand at December 31, 2007 (see Note 5) (a) 143,548

Oakley other intangibles, net of accumulated

amortization of Euro 1,099 thousand at December 31, 2007 (see Note 5) (c) 22,475

Other intangibles, net of accumulated amortization of Euro 54,428 thousand

and Euro 52,635 thousand as of December 31, 2007 and 2006 (c) 110,107 86,013

Total 1,306,117 830,362

a) The LensCrafters, Sunglass Hut International, OPSM, Cole and Oakley trade names are amortized on a straight-line basis over a period of 25 years and the

Ray-Ban trade names over a period of 20 years, as the Company believes these trade names to be finite-lived assets.

b) Distributor network, customer contracts and lists, and franchise agreements were identifiable intangibles recorded in connection with the acquisition of Cole

in 2004 and of Oakley in 2007. These assets have finite lives and are amortized on a straight-line basis over periods ranging between 20 and 25 years. The

weighted average amortization period is 22.2 years.

c) Other identifiable intangibles have finite lives ranging between 3 and 17 years and are amortized on a straight line basis. The weighted average amortization

period is 11.3 years. Most of these useful lives were determined based on the terms of the license agreements and non-compete agreements. During 2006,

approximately Euro 11.4 million of intangibles related to a non compete agreement of Sunglass Hut International became fully amortized and were written off.

During 2007, approximately Euro 5.8 million of intangibles became fully amortized and were written off.

Intangible assets-net consist of the following:

Years ending December 31 (Euro/000)

2008 81,618

2009 78,526

2010 78,253

2011 78,823

2012 76,826