LensCrafters 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 134 | ANNUAL REPORT 2007

measurement approach. In addition, acquisition related expenses will be expensed as incurred and

not included in the purchase price allocation and contingent liabilities will be separated into two

categories, contractual and non-contractual, and accounted for based on which category the

contingency falls into. This statement applies prospectively and is effective for business

combinations for which the acquisition date is on or after the beginning of the first annual reporting

period beginning after December 15, 2008. Since it will be applied prospectively it will not have an

effect on the current financial statements, however, since the Company participates in business

combinations, in the future the Company believes this statement after the adoption date could have

a significant effect on future operations.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities - Including an amendment of FASB No. 115, which allows the Company to elect

to record at fair value financial assets and liabilities, on an instrument by instrument basis, with the

change being recorded in earnings. Such election is irrevocable after elected for that instrument and

must be applied to the entire instrument. The adoption of such standard is for fiscal years beginning

after November 15, 2007. The adoption is not expected to have a material effect on the consolidated

financial statements.

In September 2006, FASB issued SFAS No. 157, Fair Value Measurements, which establishes a

definition of fair value, establishes a framework for measuring fair value and expands disclosures

about fair value measurements. SFAS No. 157 does not require new fair value measurements but

clarifies the definition, method and disclosure requirements of previously issued standards that

address fair value measurements. The adoption of such standard is for fiscal years beginning after

November 15, 2007. The Company is currently evaluating the accounting and disclosure

requirements and their effect on the consolidated financial statements.

In September 2006, FASB issued SFAS No. 158, Employer’s Accounting for Defined Benefit Pension

Other Post Retirement Plans, which requires the Company to recognize an asset or liability for the

funded status (difference between fair value of plan assets and benefit obligation, which for defined

benefit pension plans is deemed to be the Projected Benefit Obligation) of its retirement plans and

recognize changes in the funded status annually through other comprehensive income (“O.C.I.”).

Additionally, the statement changes the date as of which the funded status can be measured

(eliminates the 90 day window) with limited exceptions. The effective date of the recognition of the

funded status is for years ending after December 15, 2006, and as such, refer to Note 10 for the

effect on adoption. The effective date for the change in acceptable measurement date is for fiscal

years ending after December 15, 2008. The Company is currently evaluating the impact on the

consolidated financial statements of changing its measurement date.

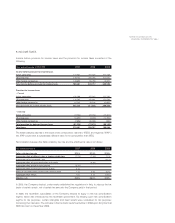

2. RELATED PARTY TRANSACTIONS

Fixed assets. In 2002, a subsidiary of the Company entered into an agreement with the

Company’s Chairman to lease to him a portion of a building for Euro 0.5 million annually. The

expiration date of this lease is 2010.

As of December 31, 2007 the receivable from the Company’s Chairman amounts to Euro 0.3 million

(Euro 0.2 million as of December 31, 2006).

License agreement. The Company has a worldwide exclusive license agreement to manufacture

and distribute ophthalmic products under the name of Brooks Brothers. The Brooks Brothers trade