LensCrafters 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 139 <

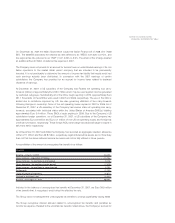

• On July 1, 2006, the Company acquired certain assets and assumed certain liabilities from King

Optical Group Inc. consisting of its 74 Canadian optical store chain known as Shoppers Optical

(“SO”). The aggregate consideration paid by the Company to the former owners of SO was

approximately Canadian dollar (“CDN$”) 68.8 million (Euro 48.3 million) in cash. In connection

with the acquisition, the Company assumed no indebtedness. The purchase price of CDN$

69.3 million (Euro 48.7 million), including approximately CDN$ 0.1 million (Euro 0.4 million) of

direct acquisition-related expenses, was allocated to the assets acquired and liabilities

assumed based on their fair value at the date of the acquisition. All valuations of net assets

including but not limited to fixed assets and inventory have been completed during 2007

resulting in no material differences from the purchase price allocation done in 2006. The

acquisition was made as a result of the Company’s strategy to continue expansion of its retail

business in Canada.

• In July 2005, the Company announced that SPV Zeta S.r.l., a new wholly owned Italian

subsidiary, would acquire 100% of the equity interest in Beijing Xueliang Optical Technology Co.

Ltd. (“Xueliang Optical”) for a purchase price of Chinese Renminbi (“RMB”) 169 million

(approximately Euro 17 million), plus RMB 40 million (approximately Euro 4 million) in assumed

liabilities. Xueliang Optical has 79 stores in Beijing. The transaction was completed in April 2006

after the customary approvals by the relevant Chinese governmental authorities. The acquisition

was accounted for in accordance with SFAS 141 and, accordingly, the total consideration of

Euro 22.6 million has been allocated to the fair market value of the assets and liabilities of the

company at the acquisition date. All valuations of net assets including but not limited to fixed

assets and inventory have been completed during 2007 with no material differences from the

purchase price allocation performed in 2006, which resulted in the recognition of goodwill of

Euro 21.3 million as of the date of acquisition. The acquisition was made as a result of the

Company’s strategy to enter the retail business in The People’s Republic of China.

• In October 2005, the Company announced that its new wholly owned Italian subsidiary, SPV Eta

S.r.l., would acquire 100% of the equity interests in Ming Long Optical, the largest premium

optical chain in the province of Guangdong, China, for a purchase price of RMB 290 million

(approximately Euro 29 million). In July 2006 the Company completed the transaction after

receiving the customary approvals by the relevant Chinese governmental authorities. Ming Long

Optical operates a total of 278 locations in two of the top premium optical markets in mainland

China, as well as in Hong Kong. The acquisition was accounted for in accordance with SFAS

141 and, accordingly, the total consideration of Euro 30.3 million has been allocated to the fair

market value of the assets and liabilities of the company at the acquisition date. All valuations of

net assets including but not limited to fixed assets and inventory have been completed during

2007 with no material differences from the purchase price allocation performed in 2006, which

resulted in the recognition of goodwill of Euro 15.8 million as of the date of acquisition. The

acquisition was made as a result of the Company’s strategy to continue expansion of its retail

business in The People’s Republic of China.

• In May 2006, the Company completed the purchase of the remaining 49% stake of the Turkish-

based distributor Luxottica Gozluk Ticaret A.S. (“Luxottica Turchia”) for an amount of Euro 15

million. Goodwill of Euro 7.0 million representing the excess of the net assets acquired has

been recorded in the accompanying Consolidated Balance Sheets. In November 2006

Standard Gozluk Industri Ve Tircaret A.S. (“Standard”), a Turkish wholesaler fully owned by the

former minority shareholders of Luxottica Turchia, merged with Luxottica Turchia. As a result of

the merger the former shareholders of Standard received a minority stake of Luxottica Turchia of

35.16% and a put option to sell the shares to the Company, while the Company was granted a

call option on the minority stake. The acquisition was accounted for in accordance with SFAS