LensCrafters 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 137 <

5. ACQUISITIONS AND INVESTMENTS

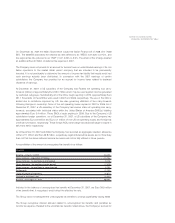

a) Oakley

On June 20, 2007, the Company and Oakley entered into a definitive merger agreement with the

unanimous approval of the Boards of Directors of both companies. On November 14, 2007, the

merger was consummated, the Company acquired all the outstanding common stock of Oakley

which became a wholly owned subsidiary of the Company and its results of operations began to be

included in the consolidated statements of income of the Company. The aggregate consideration

paid by the Company to the former shareholders, option holders, and holders of other equity rights

of Oakley was approximately Euro 1,425.6 million (US$ 2,091 million) in cash. In connection with the

merger, the Company assumed approximately Euro 166.6 million (US$ 244.4 million) of outstanding

indebtedness. The purchase price of 1,438.7 million (US$ 2,110.5 million) including approximately

Euro 13.1 million (US$ 19.2 million) of direct acquisition related expenses was allocated to the

assets acquired and liabilities assumed based on their fair value at the date of the acquisition. The

Company used various methods to calculate the fair value of the assets acquired and the liabilities

assumed. Although all valuations are not yet completed, the Company believes that the preliminary

allocation of the purchase price is reasonable, but is subject to revisions upon completion of the

final valuation of certain assets and liabilities, which is expected to occur during 2008. As such, the

final allocation of the purchase price among the assets and liabilities acquired may change in 2008

to reflect the final amounts. The excess of purchase price over net assets acquired (“goodwill”) has

been recorded in the accompanying consolidated balance sheet. No portion of this goodwill is

deductible for tax purposes. The acquisition of Oakley was made as a result of the Company’s

strategy to strengthen its performance sunglass wholesale and retail businesses worldwide.

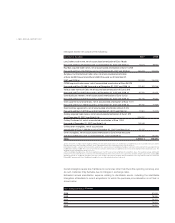

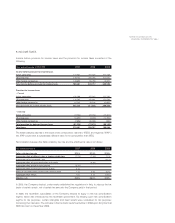

The purchase price (including acquisition-related expenses) has been allocated based upon the fair

value of the assets acquired and liabilities assumed as follows:

(Euro/000)

ASSETS ACQUIRED

Cash and cash equivalents 62,396

Inventories 132,267

Property, plant and equipment 142,483

Deferred tax assets 29,714

Prepaid expenses and other current assets 11,326

Accounts receivable 104,569

Trade names and other intangible 544,578

Other assets 3,978

LIABILITIES ASSUMED

Accounts payable (36,285)

Accrued expenses and other current liabilities (82,434)

Deferred tax liabilities (183,046)

Outstanding borrowings on credit facilities (166,577)

Other long term liabilities (22,891)

Bank overdrafts (5,575)

Fair value of net assets 534,502

Goodwill 904,148

TOTAL PURCHASE PRICE 1,438,650