LensCrafters 2007 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 140 | ANNUAL REPORT 2007

141 and, accordingly, the total consideration of Euro 46.7 million has been allocated to the fair

market value of the assets and liabilities of the company at the acquisition date. All valuations of

net assets including but not limited to fixed assets and inventory have been completed during

2007 resulting in the recognition of intangible assets of approximately Euro 19.6 million and

related deferred tax liabilities for approximately Euro 3.9 million and in the reduction of the

goodwill recognized in 2006 by approximately Euro 15.7 million. The acquisition was made as a

result of the Company’s strategy to continue expansion of its wholesale business in Turkey, in

particular in the prescription frames market.

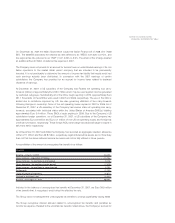

• In November 2006, the Company completed the acquisition, which was announced in June

2006, of Modern Sight Optics, a leading premium optical chain that operates a total of 28

stores in Shanghai, China. These stores are located in premium and high-end commercial

centers and shopping malls situated primarily in Shanghai’s downtown area and affluent

residential areas. The Company acquired 100% of the equity interest in Modern Sight Optics for

total consideration of RMB 140 million (approximately Euro 14 million). The acquisition was

accounted for in accordance with SFAS 141 and, accordingly, the total consideration of Euro

16.3 million, including direct acquisition-related expenses, has been allocated to the fair market

value of the assets and liabilities of the company as of the acquisition date. All valuations of net

assets including but not limited to fixed assets and inventory have been completed during 2007

with no material differences from the purchase price allocation done in 2006 which resulted in

the recognition of goodwill of Euro 15.9 million as of the date of acquisition. The acquisition was

made as a result of the Company’s strategy to continue expansion of its retail business in The

People’s Republic of China.

• In March 2007 the Company announced that it had acquired two prominent specialty sun

chains in South Africa, with a total of 65 stores. The two acquisitions represent an important

step in the expansion of the Company’s sun retail presence worldwide. Luxottica Group’s total

investment in the two transactions was approximately Euro 10 million. The Company used

various methods to calculate the fair value of the assets acquired and liabilities assumed and

all valuations are not yet completed. The excess of the purchase price over net assets acquired

(“goodwill”) has been recorded in the accompanying consolidated balance sheet. The

estimated preliminary goodwill totals Euro 8.3 million.