LensCrafters 2007 Annual Report Download - page 136

Download and view the complete annual report

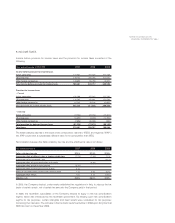

Please find page 136 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 135 <

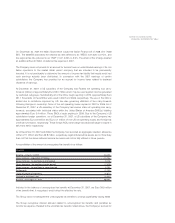

name is owned by Retail Brand Alliance, Inc. (“RBA”), which is owned and controlled by a Director

of the Company. The license agreement expires in 2009. Royalties paid to RBA for such agreement

were Euro 0.9 million, Euro 1.3 million and Euro 0.5 million in fiscal years 2007, 2006 and 2005

respectively.

In July 2004, the Company signed a worldwide exclusive license agreement to manufacture and

distribute ophthalmic products under the name of Adrienne Vittadini. The Adrienne Vittadini trade

name was owned by RBA until November 2006 when the license was sold by RBA to a party

unrelated to the Company. For fiscal years 2006 and 2005 royalties paid to RBA for such agreement

were Euro 1.0 million and Euro 0.9 million.

As of December 31, 2007 the balance of accounts receivable and payable related to RBA (including

service revenues described in the next paragraph) amount to Euro 0.0 million and Euro 0.4 million,

respectively (Euro 0.1 million and Euro 0.7 million, as of December 31, 2006).

Service revenues. During fiscal years 2007, 2006 and 2005, subsidiaries of Luxottica U.S.

Holdings Corp. (“US Holdings”) performed certain services for RBA. Amounts received for the

services provided were Euro 0.2 million, Euro 0.7 million and Euro 0.6 million, in fiscal 2007, 2006

and 2005, respectively.

Stock incentive plan. On September 14, 2004, the Company announced that its majority

shareholder, Mr. Leonardo Del Vecchio, had allocated shares held through La Leonardo Finanziaria

S.r.l. (subsequently merged into Delfin S.a.r.l.), a holding company of the Del Vecchio family,

representing at that time 2.11% (or 9.6 million shares) of the Company’s authorized and issued

share capital, to a stock option plan for top management of the Company. The stock options to be

issued under the stock option plan vested upon the meeting of certain economic objectives as of

June 30, 2006 and, as such, the holders of these options became entitled to exercise such options

beginning on that date until their termination in 2014. In 2007, 400,000 options from this grant were

exercised.

Transactions with former chairman of Oakley. Certain of the Company’s Oakley associates

perform services for a company owned by the former chairman of Oakley. Total billings for services

rendered by Oakley were Euro 0.4 million since the acquisition date. The agreement governing the

provision of these services can be terminated at any time with a 30 day written notice. In addition,

Oakley may incur other costs on behalf of the former chairman and such company that are

reimbursed after such amounts are paid by Oakley or with a prepaid deposit. As of December 31,

2007, the aggregate amount due from the former chairman and such company was approximately

Euro 0.1 million.

Oakley leases an aircraft from a different corporation owned by the former chairman of Oakley which

expires January 31, 2009, subject to automatic annual extensions unless Oakley, in its discretion,

terminates the agreement as of such date or any subsequent expiration date. The annual lease

payment is approximately Euro 0.1 million and the Company bears all costs and expenses of

operating and maintaining the aircraft. Oakley entered into time sharing agreements with the former

chairman and various other entities controlled by him whereby the Company is reimbursed for costs

of the aircraft when utilized by the former chairman or such other entities.

As of December 31, 2007 total receivables and payables from/to other related parties not

considered in the above reported paragraphs amount to Euro 0.9 million and Euro 0.7 million,

respectively (Euro 1.3 million and Euro 0.2 million as of December 31, 2006). These amounts mainly

refer to commercial transactions with the companies Type 20 S.r.l. and Optica Limited.