LensCrafters 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

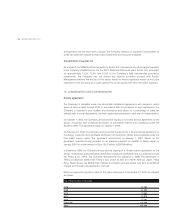

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |163 <

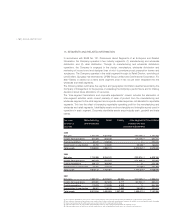

The geographic segments include Italy, the main manufacturing and distribution base, United

States and Canada (which includes the United States of America, Canada and Caribbean islands),

Asia Pacific (which includes Australia, New Zealand, China, Hong Kong, Japan) and Other (which

includes all other geographic locations including Europe (excluding Italy), South and Central

America and the Middle East). Sales are attributed to geographic segments based on the legal

entity domicile where the sale is originated. Intercompany sales included in inter-segment

elimination are accounted for on a cost plus mark-up basis.

(5) No single customer represents five percent or more of sales in any year presented.

(6) Sales, income from operations and identifiable assets are the result of combination of legal entities located in the same geographic area.

14. FINANCIAL INSTRUMENTS

Concentration of credit risk

Financial instruments which potentially expose the Company to concentration of credit risk consist

primarily of cash investments, accounts receivable and a Euro 17.9 million Pay In Kind (“PIK”) note

received in connection with the sale of its Things Remembered specialty gift business (See Note 4).

The increase in the principal balance of the PIK note as a result of unpaid interest on this note

receivable was Euro 2.8 million and Euro 0.8 million as of December 31, 2007 and 2006, respectively.

The Company attempts to limit its credit risk associated with cash equivalents by placing the

Company’s investments with highly rated banks and financial institutions. With respect to accounts

receivable, the Company limits its credit risk by performing ongoing credit evaluations. As of

December 31, 2006 and 2007, no single customer balances comprised 10% or more of the overall

accounts receivable balance. However, included in accounts receivable as of December 31, 2007

and 2006, was approximately Euro 12.3 million and Euro 13.9 million, respectively, due from the host

stores of our license brands retail division. These receivables represent cash proceeds from sales

deposited into the host stores bank accounts, which are subsequently forwarded to the Company on

a weekly or monthly basis depending on the contract. These receivables are based on contractual

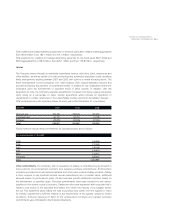

Year ended Italy United States Asia Other Adjustments Consolidated

December 31 (6) and Canada -Pacific (6) and

(Euro/000) (6) (6) eliminations

2005

Net sales (5) 998,420 2,811,860 516,793 575,196 (768,006) 4,134,263

Income from operations 258,391 291,438 46,993 51,200 (66,621) 581,401

Long lived assets, net 228,841 375,776 92,335 8,214 - 705,166

Total assets 1,294,955 2,932,483 662,926 270,169 (187,011) 4,973,522

2006

Net sales (5) 1,321,887 3,076,503 603,640 761,955 (1,087,828) 4,676,156

Income from operations 389,275 331,002 33,841 79,397 (77,528) 755,987

Long lived assets, net 280,692 387,861 110,099 8,549 - 787,201

Total assets 1,331,719 2,675,833 748,305 388,825 (175,804) 4,968,878

2007

Net sales (5) 1,506,077 3,073,086 685,561 1,114,429 (1,413,099) 4,966,054

Income from operations 377,799 324,167 57,191 127,761 (53,605) 833,313

Long lived assets, net 326,978 575,566 134,435 20,803 - 1,057,782

Total assets 1,894,546 4,839,680 804,786 752,818 (1,134,565) 7,157,266