LensCrafters 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

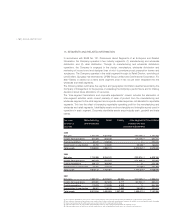

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 161 <

12. SHAREHOLDERS' EQUITY

In June 2007 and May 2006, the Company’s Annual Shareholders Meetings approved cash

dividends of Euro 191.1 million and Euro 131.4 million, respectively. These amounts became

payable in June 2007 and May 2006, respectively. Italian law requires that five percent of net income

be retained as a legal reserve until this reserve is equal to one-fifth of the issued share capital. As

such, this legal reserve is not available for dividends to the shareholders. Legal reserves of the

Italian entities included in retained earnings were Euro 5.5 million at December 31, 2007 and 2006,

respectively.

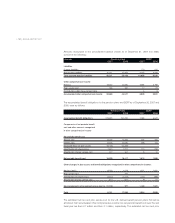

Luxottica Group’s legal reserve roll-forward for fiscal period 2005-2007 is detailed as follows:

Previously the Board of Directors authorized US Holdings to repurchase through the open market

up to 21,500,000 ADRs of Luxottica Group S.p.A., representing at that time approximately 4.7% of

the authorized and issued share capital. As of December 31, 2004, both repurchase programs

expired and US Holdings purchased 6,434,786 (1,911,700 in 2002 and 4,523,786 in 2003) ADRs at

an aggregate purchase price of Euro 70.0 million (US$ 73.8 million translated at the exchange rate

at the time of the transactions). In connection with the repurchase, an amount of Euro 70.0 million

is classified as treasury shares in the Company’s consolidated financial statements. The market

value of the stock based on the share price as listed on the Milan Stock Exchange at December 31,

2007, is approximately Euro 139.9 million (US$ 203.9 million).

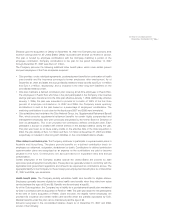

(In thousands of Euro, except share data) Year ended

December 31,

2005

Net income as reported 342,294

Add: Stock-based compensation cost included in the reported

net income, net of taxes 21,706

Deduct: Stock-based compensation expense determined under

fair-value based method for all awards, net of taxes 23,203

Pro forma 340,797

Basic earnings per share:

As reported 0.76

Pro forma 0.76

Diluted earnings per share:

As reported 0.76

Pro forma 0.75

(Euro/000)

January 1, 2005 5,454

Increase in fiscal year 2005 23

December 31, 2005 5,477

Increase in fiscal year 2006 36

December 31, 2006 5,513

Increase in fiscal year 2007 23

December 31, 2007 5,536