LensCrafters 2007 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 151 <

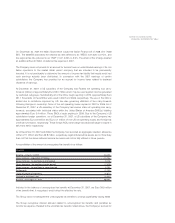

using the same actuarial methods and assumptions as those used for the qualified pension plan.

Starting January 1, 2006, this plan’s benefit provisions were amended to mirror the changes made

to the Company’s qualified pension plan.

A subsidiary of the Company sponsors the Cole National Group, Inc. Supplemental Pension Plan.

This plan is a nonqualified unfunded supplemental executive retirement plan for certain participants

of the Cole pension plan who were designated by the Board of Directors of Cole on the

recommendation of Cole’s Chief Executive Officer at such time. This plan provides benefits in

excess of amounts permitted under the provisions of the prevailing tax law. The pension liability and

expense associated with this plan are accrued using the same actuarial methods and assumptions

as those used for the qualified pension plan.

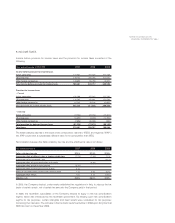

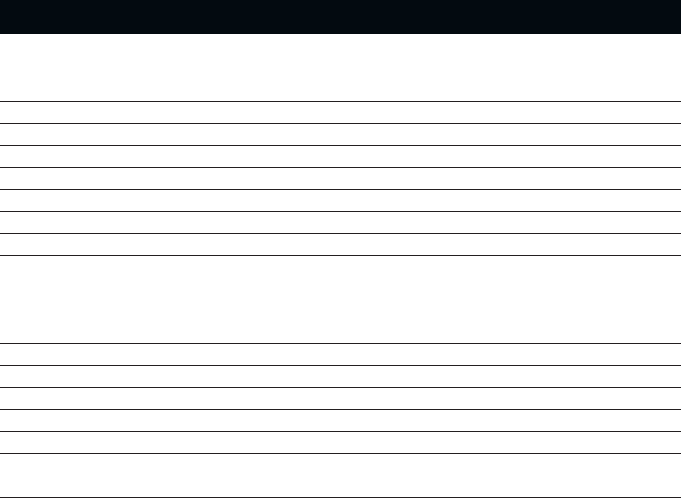

The following tables provide key information pertaining to the Company’s U.S. pension plans and

SERP. The Company uses a September 30 measurement date for these plans.

Obligations and Funded Status:

(Euro/000) Pension plans SERP

2007 2006 2007 2006

Change in benefit obligations:

Benefit obligation - beginning of period 272,248 278,947 8,320 6,530

Service cost 16,449 13,326 504 335

Interest cost 15,606 15,090 589 442

Actuarial (gain)/loss (1,690) 3,195 1,871 1,832

Plan amendments - 297 --

Benefits paid (8,573) (9,373) (219) (23)

Translation difference (27,254) (29,234) (970) (796)

Benefit obligation - end of period 266,786 272,248 10,095 8,320

Change in plan assets:

Fair value of plan assets - beginning

of period 216,792 206,316 --

Actual return on plan assets 24,203 14,514 --

Employer contribution 16,717 27,610 219 23

Benefits paid (8,573) (9,373) (219) (23)

Translation difference (22,564) (22,275) --

Fair value of plan assets - end of period 226,575 216,792 - -

Funded status (40,211) (55,456) (10,095) (8,320)