LensCrafters 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

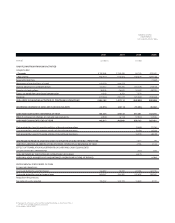

2007 2006 2005

Weighted average shares outstanding - basic 455,184,797 452,897,854 450,179,073

Effect of dilutive stock options 3,345,812 3,287,796 3,124,353

Weighted average shares outstanding - dilutive 458,530,609 456,185,650 453,303,426

Options not included in calculation of dilutive

shares as the exercise price was greater than

the average price during the respective period 4,947,775 6,885,893 569,124

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 131 <

years 2007, 2006 and 2005 for such reimbursement were Euro 16.8 million, Euro 19.2 million and

Euro 15.5 million, respectively.

Earnings per share. Luxottica Group calculates basic and diluted earnings per share in

accordance with SFAS No. 128, Earnings per Share. Net income available to shareholders is the

same for the basic and diluted earnings per share calculations for the years ended December 31,

2007, 2006 and 2005. Basic earnings per share are based on the weighted average number of

shares of common stock outstanding during the period. Diluted earnings per share are based on

the weighted average number of shares of common stock and common stock equivalents

(options) outstanding during the period, except when the common stock equivalents are anti-

dilutive. The following is a reconciliation from basic to diluted shares outstanding used in the

calculation of earnings per share:

Stock-based compensation. Stock-based compensation represents the cost related to stock-

based awards granted to employees. Stock-based compensation cost is measured at grant date

based on the estimated fair value of the award and recognizes the cost on a straight-line basis (net

of estimated forfeitures) over the employee requisite service period. The fair value of stock options

is estimated using a binomial lattice valuation technique. Deferred tax assets are recorded for

awards that result in deductions on income tax returns, based on the amount of compensation

cost recognized and the statutory tax rate in the jurisdiction in which the deduction will be received.

Differences between the deferred tax assets recognized for financial reporting purposes and the

actual tax deduction reported on the income tax return are recorded in Additional Paid-In Capital (if

the tax deduction exceeds the deferred tax asset) or in the consolidated statements of income (if

the deferred tax asset exceeds the tax deduction and no additional paid-in capital exists from

previous awards).

Fair value of financial instruments. Financial instruments consist primarily of cash and cash

equivalents, marketable securities, debt obligations, and derivative financial instruments which are

either accounted for as fair value or cash flow hedges, and starting in 2006, financial instruments

also include a note receivable from a third party for the sale of Things Remembered Inc. (“TR

Note”). Luxottica Group estimates the fair value of cash and cash equivalents and marketable

securities based on interest rates available to the Company and by comparison to quoted market

prices and its debt obligations, as there are no quoted market prices, based on interest rates

available to the Company. The fair value associated with financial guarantees has been accrued for

when applicable and is disclosed in Note 15. The fair values of letters of credit are not disclosed as

it is not practicable for the Company to do so and substantially all of these instruments are in place

for operational purposes such as security on leases and health benefits. The fair value of the TR

Note was based on discounted projected cash flows utilizing an expected yield.

At December 31, 2007 and 2006, the fair value of the Company's financial instruments

approximated the carrying value except as otherwise disclosed.