LensCrafters 2007 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 167 <

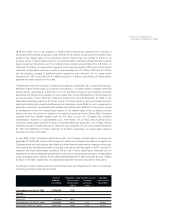

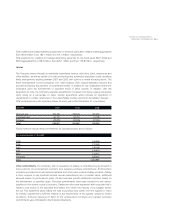

annually, can be cancelled at short notice and have no commitment fees. At December 31, 2007, there

were Euro 22.0 million (US$ 32.1 million) of borrowings outstanding and there were Euro 23.6 million in

aggregate face amount of standby letters of credit outstanding under these lines of credit (see below).

The blended average interest rate on these lines of credit is approximately LIBOR plus 0.25%.

Outstanding standby letters of credit

A U.S. subsidiary has obtained various standby and trade letters of credit from banks that

aggregated Euro 31.0 million and Euro 36.1 million as of December 31, 2007 and 2006, respectively.

Most of these letters of credit are used for security in risk management contracts, purchases from

foreign vendors or as security on store leases. Most standby letters of credit contain evergreen

clauses under which the letter is automatically renewed unless the bank is notified not to renew.

Trade letters of credit are for purchases from foreign vendors and are generally outstanding for a

period that is less than six months. Substantially all the fees associated with maintaining the letters

of credit fall within the range of 50 to 100 basis points annually.

Litigation

California Vision Health Care Service Plan Lawsuit

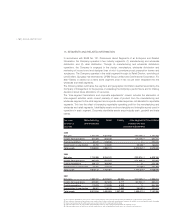

In March 2002, in Snow v. LensCrafters, Inc. et al., an individual commenced an action in the California

Superior Court for the County of San Francisco against Luxottica Group S.p.A. and certain of its

subsidiaries, including LensCrafters, Inc. and EYEXAM of California, Inc. The plaintiff, along with a

second plaintiff named in an amended complaint, seeks to certify this case as a class action. The

claims have been partially dismissed. The remaining claims, against LensCrafters and EYEXAM,

allege various statutory violations relating to the confidentiality of medical information and the

operation of LensCrafters’ stores in California, including violations of California laws governing

relationships among opticians, optical retailers, manufacturers of frames and lenses and optometrists,

and other unlawful or unfair business practices. The action seeks unspecified damages, statutory

damages of U.S.$1,000 per class member, disgorgement, restitution of allegedly unjustly obtained

sums, punitive damages and injunctive relief, including an injunction that would prohibit defendants

from providing eye examinations or other optometric services at LensCrafters stores in California.

The parties have reached a settlement which offers a range of benefits, including store vouchers

and a cash back option, along with certain enhancements to LensCrafters' business practices. On

February 4, 2008, the Court gave preliminary approval to a class action settlement. A hearing to

address final approval will take place in July 2008. If the settlement is given final approval, and no

appeals are taken, this matter will be resolved.

Although the Company believes that its operational practices and advertising in California comply with

California law, if the settlement does not receive final approval and an adverse decision in Snow results,

LensCrafters and EYEXAM may have to modify or cease their activities in California. In addition,

LensCrafters and EYEXAM might be required to pay damages and/or restitution, the amount of which

might have a material adverse effect on the Company’s consolidated financial statements. Costs

associated with the Snow litigation incurred for the years ended December 31, 2007 and 2006, were

approximately Euro 1.1 million and Euro 0.7 million, respectively. For the year ended December 31, 2007,

the Company recorded an accrual of Euro 0.9 million as an estimate of the minimum amount it believes it

will pay as costs of settlement as it has become probable that such amount will be paid in 2008. Currently,

the maximum amount which may need to be paid under the settlement conditions cannot be quantified.

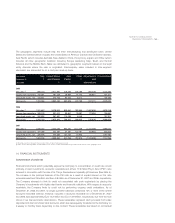

People v. Cole

In February 2002, the State of California commenced an action in the California Superior Court for

the County of San Diego against Cole and certain of its subsidiaries, including Pearle Vision, Inc.