LensCrafters 2007 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 146 | ANNUAL REPORT 2007

penalties and interest during 2007 is immaterial and in total, as of December 31, 2007, the Company

has recognized a liability for penalties of approximately Euro 5.9 million and interest of

approximately Euro 9.6 million.

The Group is subject to taxation in Italy and foreign jurisdictions of which only the U.S. federal is

significant.

Italian companies’ taxes are subject to review pursuant to Italian law. As of December 31, 2007, tax

years from 2002 through the most recent year were open for such review. Certain Luxottica Group

subsidiaries are subject to tax reviews for previous years and, during 2005 a wholly owned Italian

subsidiary was subjected to a tax inspection. As a result of this, some insignificant recorded losses

were reversed and an immaterial amount was accrued for as a liability. Management believes no

significant unaccrued liabilities will arise from the related tax reviews.

The Group’s U.S. federal tax years for 2004, 2005 and 2006 are subject to examination by the tax

authorities.

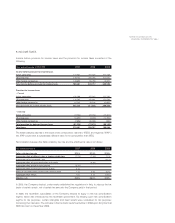

9. LONG-TERM DEBT

Long-term debt consists of the following:

Year ended December 31 (Euro/000) 2007 2006

Credit agreement with various Italian financial institutions (a) 185,000 245,000

Senior unsecured guaranteed notes (b) 97,880 165,022

Credit agreement with various financial institutions (c) 1,059,918 895,240

Credit agreement with various financial institutions for Oakley Acquisition (e) 1,369,582 -

QCapital lease obligations, payable in installments through 2007 1,866 3,626

Other loans with banks and other third parties, interest at various rates

payable in installments through 2014. Certain subsidiaries' fixed assets are

pledged as collateral for such loans (d) 4,894 10,374

Total 2,719,140 1,319,262

Current maturities 792,617 359,527

(a) In September 2003, the Company acquired its ownership interest of OPSM and more than 90%

of the performance rights and options of OPSM for an aggregate of AUD 442.7 million (Euro 253.7

million), including acquisition expenses. The purchase price was paid for with the proceeds of a

credit facility with Banca Intesa S.p.A. of Euro 200 million, in addition to other short-term lines

available. The credit facility includes a Euro 150 million term loan, which requires repayment of

equal semi-annual instalments of principal of Euro 30 million starting on September 30, 2006 until

the final maturity date. Interest accrues on the term loan at Euribor (as defined in the agreement)

plus 0.55% (5.315% on December 31, 2007). The revolving loan provides borrowing availability of

up to Euro 50 million; amounts borrowed under the revolving portion can be borrowed and repaid

until final maturity. At December 31, 2007, Euro 25 million had been drawn from the revolving

portion. Interest accrues on the revolving loan at Euribor (as defined in the agreement) plus 0.55%

(4.988% on December 31, 2007). The final maturity of the credit facility is September 30, 2008. The

Company can select interest periods of one, two or three months. The credit facility contains

certain financial and operating covenants. The Company was in compliance with those covenants

as of December 31, 2007. Under this credit facility Euro 85 million and Euro 145 million were

borrowed as of December 31, 2007 and 2006, respectively.