LensCrafters 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>164 |ANNUAL REPORT 2007

arrangements that are short term in length. The Company believes no significant concentration of

credit risk exists with respect to these cash investments and accounts receivable.

Concentration of supplier risk

As a result of the OPSM and Cole acquisitions, Essilor S.A. has become one of the largest suppliers

to the Company’s Retail Division. For the 2007, 2006 and 2005 fiscal years, Essilor S.A. accounted

for approximately 15.0%, 15.0% and 10.0% of the Company’s total merchandise purchases,

respectively. The Company has not signed any specific purchase contract with Essilor.

Management believes that the loss of this vendor would not have a significant impact on the future

operations of the Company as it could replace this vendor quickly with other third-party suppliers.

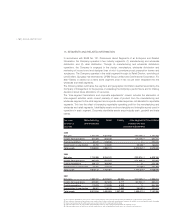

15. COMMITMENTS AND CONTINGENCIES

Royalty agreements

The Company is obligated under non-cancellable distribution agreements with designers, which

expire at various dates through 2013. In accordance with the provisions of such agreements, the

Company is required to pay royalties and advertising fees based on a percentage of sales (as

defined) with, in certain agreements, minimum guaranteed payments in each year of the agreements.

On October 7, 2005, the Company announced the signing of a 10-year license agreement for the

design, production and worldwide distribution of prescription frames and sunglasses under the

Burberry name. The agreement began on January 1, 2006.

On February 27, 2006, the Company announced that it entered into a 10-year license agreement for

the design, production and worldwide distribution of prescription frames and sunglasses under the

Polo Ralph Lauren name. The agreement commenced on January 1, 2007. Based on the

agreement, Luxottica Group provided for an advance payment on royalties to Ralph Lauren in

January 2007 for a total amount of Euro 150.2 million (US$ 199 million).

In December 2006, the Company announced the signing of a 10-year license agreement for the

design, manufacturing and worldwide distribution of exclusive ophthalmic and sun collections under

the Tiffany & Co. name. The Company launched the first collection in 2008. The distribution of

Tiffany’s collections started with Tiffany’s own stores as well as in North America, Japan, Hong

Kong, South Korea, key Middle East markets and Mexico and will extend over time to additional

markets and through new distribution channels.

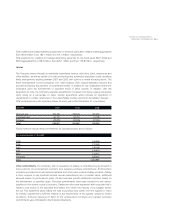

Minimum payments required in each of the years subsequent to December 31, 2007 are detailed

as follows:

Year ending December 31 (Euro/000)

2008 85,462

2009 81,683

2010 72,989

2011 52,319

2012 37,081

Thereafter 128,549

Total 458,083