LensCrafters 2007 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 156 | ANNUAL REPORT 2007

Amounts recognized in accumulated other comprehensive income are not material.

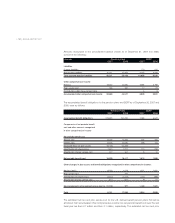

Benefit payments. The following estimated future benefit payments for the health benefit plans,

which reflect expected future service, are estimated to be paid in the years indicated for both the

Holdings and Cole plans:

(Euro/000) 2007 2006

Liabilities:

Current liabilities 173 185

Non-current liabilities 3,260 3,650

Total accrued postretirement liabilities 3,433 3,835

(Euro/000)

2008 173

2009 200

2010 214

2011 234

2012 258

2013-2017 1,637

Contributions. The expected contributions for 2008 are Euro 0.2 million for the Company and Euro

0.1 million for the employee participants.

For 2007, a 11.5% (12% for 2006) increase in the cost of covered health care benefits was assumed.

This rate was assumed to decrease gradually to 5% for 2020 and remain at that level thereafter. The

health care cost trend rate assumption could have a significant effect on the amounts reported. A

1% increase or decrease in the health care trend rate would not have a material impact on the

consolidated financial statements. The weighted-average discount rate used in determining the

accumulated postretirement benefit obligation was 6.5% at September 30, 2007 and 6.0% at

September 30, 2006.

The weighted average discount rate used in determining the net periodic benefit cost was 6.0% for

2007 and 5.75% for 2006.

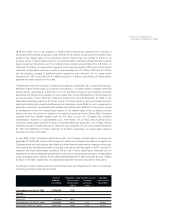

Implementation of SFAS No. 158. In the fourth quarter of 2006, the Company adopted Statement

of Financial Accounting Standards No. 158, Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)

(“SFAS No. 158”) which requires employers to recognize on the balance sheet the projected

benefit obligation of pension plans and the accumulated postretirement benefit obligation for any

other postretirement plan. This requirement replaces the requirement of SFAS No. 87 to report a

minimum pension liability measured as the excess of the accumulated benefit obligation over the

fair value of plan assets and any recorded pension accrual. SFAS No. 158 also requires employers

to recognize in other comprehensive income gains or losses and prior service costs or credits that

occur during the period but would not be recognized as net periodic benefit cost as required by

SFAS No. 87, 88, and 106. There is no change in the requirements related to the income statement

recognition of net periodic benefit costs. The incremental effect of applying SFAS No. 158 on the

consolidated balance sheet at December 31, 2006 is as follows: