LensCrafters 2007 Annual Report Download - page 170

Download and view the complete annual report

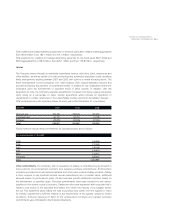

Please find page 170 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 169 <

parties are currently awaiting the Court's ruling on that motion. The Court did not rule on defendants'

demurrer to the amended complaint and it is unlikely there will be further proceedings with respect

to the action other than on plaintiff’s motion for fees as both sides have informed the Court that the

underlying case is now moot and should be dismissed once the Court rules on the fee motion.

Costs associated with this litigation incurred for the year ended December 31, 2007 were

immaterial. Management believes, based in part on the advice from counsel, that no estimate of the

range of possible losses, if any, can be made at this time.

Fair Credit Reporting Act Litigation

In January 2007, a complaint was filed against Oakley, Inc. in the United States District Court for the

Central District of California alleging willful violations of the Fair and Accurate Credit Transactions

Act, 15 U.S.C. §1681c(g) (“FACTA”), related to the inclusion of credit card expiration dates on sales

receipts. Plaintiff later filed an amended complaint adding two of Oakley's wholly-owned

subsidiaries as additional defendants. Plaintiff purports to sue on behalf of a putative class of

Oakley's customers, but no motion seeking class action status has yet been filed. The Oakley

defendants have denied any liability.

Recently, the Oakley defendants entered into a Memorandum of Understanding with Plaintiff which,

if approved by the Court, would result in the settlement of this action, with a complete release in favor

of the Oakley defendants, with no cash payment to the purported class members, but rather an

agreement by Oakley to issue vouchers for the purchase of products at Oakley retail stores during a

limited period of time. The aggregate retail value of the vouchers would depend on how many

purported class members submit valid claims. The settlement contemplated by the Memorandum of

Understanding also provides for the payment of attorneys' fees and claim administration costs by the

Oakley defendants. A motion seeking court approval of the foregoing settlement will be filed shortly.

Costs associated with this litigation incurred for the year ended December 31, 2007 were

immaterial. Management believes, based in part on the advice from counsel, that no estimate of the

range of possible losses, if any, can be made at this time.

The Company is a defendant in various other lawsuits arising in the ordinary course of business. It

is the opinion of the management of the Company that it has meritorious defenses against all such

outstanding claims, which the Company will vigorously pursue, and that the outcome of such

claims, individually or in the aggregate, will not have a material adverse effect on the Company’s

consolidated financial position or results of operations.

16. SUBSEQUENT EVENTS

On January 31, 2008, the Company announced the signing of the renewal of the partnership

agreement for eyewear collections under the CHANEL brand.

In February 2008, the Company exercised an option included in the amendment to the term and

revolving credit facility disclosed in Note 8 (d) to extend the maturity date of Tranches B and C to

March 2013.

On April 17, 2008, the Company announced the signing of a new long-term exclusive license

agreement with Stella McCartney Limited, a joint venture between Ms. Stella McCartney and Gucci

Group N.V., for the design, production and worldwide distribution of sunglasses under the luxury

lifestyle brand Stella McCartney. The agreement, which will begin on January 1, 2009, is for an initial

term of six years, automatically renewable for an additional five-year term. The first collection will be

launched in the summer of 2009.