LensCrafters 2007 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 166 | ANNUAL REPORT 2007

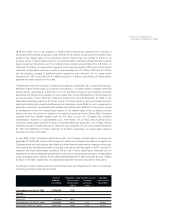

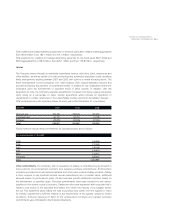

Future minimum amounts to be paid for endorsement contracts and supplier purchase

commitments at December 31, 2007, are as follows:

Guarantees

The United States Shoe Corporation, a wholly owned subsidiary of the Company, remains

contingently liable on seven store leases in the United Kingdom. These leases were previously

transferred to third parties. The third parties have assumed all future obligations of the leases from

the date each agreement was signed. However, under the common law of the United Kingdom, the

lessor still has the right to seek payment of certain amounts from the Company if unpaid by the new

obligor. If the Company is required to pay under these guarantees, it has the right to recover

amounts from the new obligor. These leases will expire during various years until December 31,

2015. At December 31, 2007, the maximum amount for which the Company’s subsidiary is

contingently liable is Euro 7.8 million.

Cole has guaranteed future minimum lease payments for certain store locations leased directly by

franchisees. These guarantees aggregated approximately Euro 4.0 million at December 31, 2007.

Performance under a guarantee by the Company is triggered by default of a franchisee on its lease

commitment. Generally, these guarantees also extend to payments of taxes and other expenses

payable under the leases, the amounts of which are not readily quantifiable. The terms of these

guarantees range from one to ten years. Many are limited to periods less than the full term of the lease

involved. Under the terms of the guarantees, Cole has the right to assume the primary obligation and

begin operating the store. In addition, as part of the franchise agreements, Cole may recover any

amounts paid under the guarantee from the defaulting franchisee. The Company has accrued a liability

at December 31, 2005 for the estimates of the fair value of the Company’s obligations from guarantees

entered into or modified after December 31, 2002, using an expected present value calculation. Such

amount is immaterial to the consolidated financial statements as of December 31, 2007 and 2006.

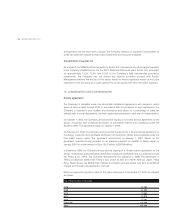

Credit facilities

As of December 31, 2007 and 2006, Luxottica Group had unused short-term lines of credit of

approximately Euro 291.4 million and Euro 581.1 million, respectively.

The Company and its wholly-owned Italian subsidiary Luxottica S.r.l. maintain unsecured lines of

credit with primary banks for an aggregate maximum credit of Euro 467.4 million (Euro 543.2 million

at December 31, 2006). These lines of credit are renewable annually, can be cancelled at short

notice and have no commitment fees. At December 31, 2007 and 2006, these credit lines were

utilized for Euro 312.0 million and Euro 68.0 million, respectively.

US Holdings maintains four unsecured lines of credit with four separate banks for an aggregate

maximum credit of Euro 89.0 million (US Dollar 130.0 million). These lines of credit are renewable

Year ending Endorsement Supplier

December 31 (Euro/000) contracts commitments

2008 5,912 4,575

2009 2,433 6,034

2010 780 5,999

2011 253 1,507

Total 9,378 18,115